A) $101.53 million

B) $98.57 million

C) $86.66 million

D) $71.07 million

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Leveraged buyouts (LBOs) occur when a firm's managers, generally backed by private equity groups, try to gain control of a publicly owned company by buying out the public shareholders using large amounts of borrowed money.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements best describes mergers?

A) Tax considerations often play a part in mergers. If one firm has excess cash, purchasing another firm exposes the purchasing firm to additional taxes. Thus, firms with excess cash rarely undertake mergers.

B) The smaller the synergistic benefits of a particular merger, the greater the scope for striking a bargain in negotiations, and the higher the probability that the merger will be completed.

C) Since mergers are frequently financed by debt rather than equity, a lower cost of debt or a greater debt capacity are rarely relevant considerations when considering a merger.

D) Managers who purchase other firms often assert that the new combined firm will enjoy benefits from diversification, including more stable earnings. However, since shareholders are free to diversify their own holdings, and at what's probably a lower cost, diversification benefits is generally not a valid motive for a publicly held firm.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Firm X is considering acquiring Firm Y by offering one of its common stock for 0.8728 shares of Y. Currently, the market price of Firm X is $48. What is the cash bidding price proposed for this deal?

A) $35

B) $42

C) $55

D) $63

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

A spin-off is a type of divestiture in which the assets of a division are sold to another firm.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In a financial merger, the relevant post-merger cash flows are simply the sum of the expected cash flows of the 2 companies, measured as if they were operated independently.

B) False

Correct Answer

verified

True

Correct Answer

verified

True/False

The present value of the free cash flows discounted at the unlevered cost of equity is the value of the firm's operations if it had no debt.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a petrochemical firm that used oil as feedstock merged with an oil producer that had large oil reserves and a drilling subsidiary, this would be a vertical merger.

B) False

Correct Answer

verified

Correct Answer

verified

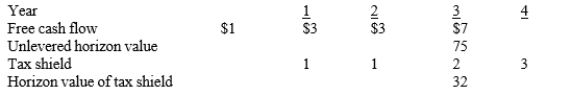

Multiple Choice

Brau Auto, a national autoparts chain, is considering purchasing a smaller chain, South Georgia Parts (SGP) . Brau's analysts project that the merger will result in the following incremental free cash flows, tax shields, and horizon values:  Assume that all cash flows occur at the end of the year. SGP is currently financed with 30% debt at a rate of 10%. The acquisition would be made immediately, and if it is undertaken, SGP would retain its current $15 million of debt and issue enough new debt to continue at the 30% target level. The interest rate would remain the same. SGP's pre-merger beta is 2.0, and its post-merger tax rate would be 34%. The risk-free rate is 8% and the market risk premium is 4%. What is the value of SGP to Brau?

Assume that all cash flows occur at the end of the year. SGP is currently financed with 30% debt at a rate of 10%. The acquisition would be made immediately, and if it is undertaken, SGP would retain its current $15 million of debt and issue enough new debt to continue at the 30% target level. The interest rate would remain the same. SGP's pre-merger beta is 2.0, and its post-merger tax rate would be 34%. The risk-free rate is 8% and the market risk premium is 4%. What is the value of SGP to Brau?

A) $53.40 million

B) $61.96 million

C) $64.64 million

D) $76.96 million

F) A) and B)

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

Two firms merge and no synergies occur. Which of the following statements best describes the result?

A) The reduction in risk in the combined firm benefits the bondholders at the expenses of the shareholders.

B) The value of the debt in the combined firm will likely be greater than the value of the debt in the two separate firms.

C) The size of the gain to the bondholders depends on the specific reductions in bankruptcy probabilities after the merger.

D) All of the above.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Blazer Inc. is thinking of acquiring Laker Company. Blazer expects Laker's NOPAT to be $9 million the first year, with no net new investment in operating capital and no interest expense. For the second year, Laker is expected to have NOPAT of $25 million and interest expense of $5 million. Also, in the second year only, Laker will need $10 million of net new investment in operating capital. Laker's marginal tax rate is 40%. After the second year, the free cash flows and the tax shields from Laker to Blazer will both grow at a constant rate of 4%. Blazer has determined that Laker's cost of equity is 17.5%, and Laker currently has no debt outstanding. Assuming that all cash flows occur at the end of the year, Blazer must pay $45 million to acquire Laker. What it the NPV of the proposed acquisition? Note that you must first calculate the value to Blazer of Laker's equity.

A) $ 45.0 million

B) $ 68.2 million

C) $ 86.5 million

D) $113.2 million

F) All of the above

Correct Answer

verified

C

Correct Answer

verified

True/False

A taxable merger offer is one where the acquiring company offers to purchase the target company with cash. However, the same deal is not taxable if the merger is paid by exchanging stocks. Such non- taxable bids should be by far more popular.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If the constant growth model is used to calculate the value of a target company, the terminal value is an insignificant cash flow analysis.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A shareholder rights plan allowing existing shareholders to buy or sell shares at very attractive prices provides the acquirer an inexpensive way for takeovers.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A congeneric merger is one where the merging firms operate in related businesses but do not necessarily produce the same products or have a producer-supplier relationship.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the value of Dustvac's equity to Magiclean? (Round your answer to the closest thousand dollars.)

A) $16,019,000

B) $17,111,000

C) $18,916,000

D) $22,111,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

By examining stock prices around merger announcement dates, event studies provide inconclusive results that mergers benefit only targets, not acquirers.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A joint venture is one in which two, or sometimes more, independent companies agree to combine resources in order to achieve a specific objective, usually limited in scope.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a valid, acceptable reason for a closely held firm proposing a merger activity?

A) synergistic benefits arising from mergers

B) reduction in competition resulting from mergers

C) attempts to stabilize earnings by diversifying

D) minimizing taxes when disposing of excess cash

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Dunbar Hardware, a national hardware chain, is considering purchasing a smaller chain, Eastern Hardware. Dunbar's analysts project that the merger will result in incremental free flows and interest tax savings with a combined present value of $72.52 million, and they have determined that the appropriate discount rate for valuing Eastern is 16%. Eastern has 4 million shares outstanding and no debt. Eastern's current price is $16.25. What is the maximum price per share that Dunbar should offer?

A) $16.25

B) $16.97

C) $17.42

D) $18.13

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 67

Related Exams