Correct Answer

verified

Correct Answer

verified

True/False

If the bondholder has the right to exchange a bond for shares of common stock, the bond is called a convertible bond.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The market interest rate related to a bond is also called the

A) stated interest rate

B) effective interest rate

C) contract interest rate

D) straight-line rate

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Bondholders' claims on the assets of the corporation rank ahead of stockholders' claims.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Bonds are sold at face value when the contract rate is equal to the market rate of interest.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The journal entry a company records for the issuance of bonds when the contract rate and the market rate are the same is to

A) debit Bonds Payable, credit Cash

B) debit Cash and Discount on Bonds Payable, credit Bonds Payable

C) debit Cash, credit Premium on Bonds Payable and Bonds Payable

D) debit Cash, credit Bonds Payable

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Essay

On the first day of the current fiscal year, $1,500,000 of 10-year, 8% bonds, with interest payable semiannually, were sold for $1,225,000. Present entries to record the following transactions for the current fiscal year: (a)Issuance of the bonds. (b)First semiannual interest payment (record as separate entry from discount amortization). (c)Amortization of bond discount for the year, using the straight-line method of amortization.

Correct Answer

verified

Correct Answer

verified

Essay

On the first day of the current fiscal year, $2,000,000 of 10-year, 7% bonds, with interest payable annually, were sold for $2,125,000. Present entries to record the following transactions for the current fiscal year: (a)Issuance of the bonds. (b)First annual interest payment (record as separate entry from premium amortization). (c)Amortization of bond premium for the year, using the straight-line method of amortization.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bonds Payable has a balance of $1,000,000, and Discount on Bonds Payable has a balance of $15,500. If the issuing corporation redeems the bonds at 98.5, what is the amount of gain or loss on redemption?

A) $500 loss

B) $15,500 loss

C) $15,500 gain

D) $500 gain

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The amortization of a premium on bonds payable decreases bond interest expense.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Callable bonds are redeemable by the issuing corporation within the period of time and at the price stated in the bond indenture.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

When a portion of a bond issue is redeemed, a related proportion of the unamortized premium or discount must be written off.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A bond indenture is

A) a contract between the corporation issuing the bonds and the underwriters selling the bonds

B) the amount due at the maturity date of the bonds

C) a contract between the corporation issuing the bonds and the bondholders

D) the amount for which the corporation can buy back the bonds prior to the maturity date

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The times interest earned ratio is calculated by dividing Bonds Payable by Interest Expense.

B) False

Correct Answer

verified

Correct Answer

verified

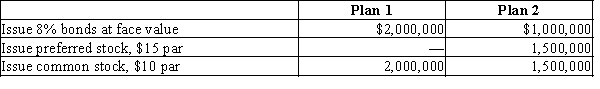

Essay

Ulmer Company is considering the following alternative financing plans:?  Income tax is estimated at 35% of income. Dividends of $1 per share were declared and paid on the preferred stock.Determine the earnings per share of common stock, assuming income before bond interest and income tax is $600,000.

Income tax is estimated at 35% of income. Dividends of $1 per share were declared and paid on the preferred stock.Determine the earnings per share of common stock, assuming income before bond interest and income tax is $600,000.

Correct Answer

verified

Correct Answer

verified

True/False

The balance in Premium on Bonds Payable should be reported as a deduction from Bonds Payable on the balance sheet.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The present value of $60,000 to be received in one year, at 6% compounded annually, is (rounded to nearest dollar)

A) $56,604

B) $63,396

C) $60,000

D) $3,396

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The journal entry a company records for the issuance of bonds when the contract rate is greater than the market rate would be

A) debit Bonds Payable, credit Cash

B) debit Cash and Discount on Bonds Payable, credit Bonds Payable

C) debit Cash, credit Premium on Bonds Payable and Bonds Payable

D) debit Cash, credit Bonds Payable

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Essay

Two companies are financed as follows:Income tax is estimated at 40% of income for both companies.Determine for each company the earnings per share of common stock, assuming that the income before bond interest and income taxes is $2,280,000 each.

Correct Answer

verified

Correct Answer

verified

True/False

The effective interest rate method produces a constant dollar amount of interest expense to be reported each interest period.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 141 - 160 of 181

Related Exams