A) Variance; correlation coefficient.

B) Standard deviation; correlation coefficient.

C) Beta; variance.

D) Coefficient of variation; beta.

E) Beta; beta.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

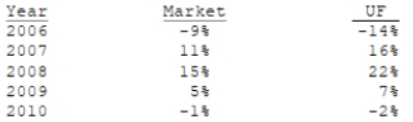

The returns on the market , the returns on united fund (UF) , the risk- free rate , and the reqired return on the united fund are shown below .

assuming the market is in equilibrium and that beta can be estimated with historical data . what is the reqired return on the market rn?

rRF: 7.00%; RUNITED: 15.00%

rRF: 7.00%; RUNITED: 15.00%

A) 10.57%

B) 11.13%

C) 11.72%

D) 12.33%

E) 12.95%

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following are the factors for the Fama-French model?

A) The excess market return, a size factor, and a book-to-market factor.

B) The excess market return, a debt factor, and a book-to-market factor.

C) The excess market return, a size factor, and a debt.

D) A debt factor, a size factor, and a book-to-market factor.

E) The excess market return, an industrial production factor, and a book-to-market factor.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Tests have shown that the betas of individual stocks are unstable over time, but that the betas of large portfolios are reasonably stable over time.

B) Richard Roll has argued that it is possible to test the CAPM to see if it is correct.

C) Tests have shown that the risk/return relationship appears to be linear, but the slope of the relationship is greater than that predicted by the CAPM.

D) Tests have shown that the betas of individual stocks are stable over time, but that the betas of large portfolios are much less stable.

E) The most widely cited study of the validity of the CAPM is one performed by Modigliani and Miller.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a portfolio of three different stocks, which of the following could NOT be true?

A) The riskiness of the portfolio is less than the riskiness of each of the stocks if they were held in isolation.

B) The riskiness of the portfolio is greater than the riskiness of one or two of the stocks.

C) The beta of the portfolio is less than the betas of each of the individual stocks.

D) The beta of the portfolio is greater than the beta of one or two of the individual stocks’ betas.

E) The beta of the portfolio can not be equal to 1.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 25 of 25

Related Exams