B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the PV of an annuity due with 5 payments of $2,500 at an interest rate of 5.5%?

A) $11,262.88

B) $11,826.02

C) $12,417.32

D) $13,038.19

E) $13,690.10

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Starting to invest early for retirement reduces the benefits of compound interest.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Wendy has $5,000 invested in a bank that pays 3.8% annually. How long will it take for her funds to triple?

A) 23.99

B) 25.26

C) 26.58

D) 27.98

E) 29.46

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your girlfriend just won the Florida lottery. She has the choice of $15,000,000 today or a 20-year annuity of $1,050,000, with the first payment coming one year from today. What rate of return is built into the annuity?

A) 3.44%

B) 3.79%

C) 4.17%

D) 4.58%

E) 5.04%

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose you inherited $275,000 and invested it at 8.25% per year. How much could you withdraw at the beginning of each of the next 20 years?

A) $22,598.63

B) $23,788.03

C) $25,040.03

D) $26,357.92

E) $27,675.82

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose a State of New York bond will pay $1,000 ten years from now. If the going interest rate on these 10-year bonds is 5.5%, how much is the bond worth today?

A) $585.43

B) $614.70

C) $645.44

D) $677.71

E) $711.59

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Suppose Sally Smith plans to invest $1,000. She can earn an effective annual rate of 5% on Security A, while Security B has an effective annual rate of 12%. After 11 years, the compounded value of Security B should be more than twice the compounded value of Security A. (Ignore risk, and assume that compounding occurs annually.)

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What annual payment must you receive in order to earn a 6.5% rate of return on a perpetuity that has a cost of $1,250?

A) $77.19

B) $81.25

C) $85.31

D) $89.58

E) $94.06

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Riverside Bank offers to lend you $50,000 at a nominal rate of 6.5%, compounded monthly. The loan (principal plus interest) must be repaid at the end of the year. Midwest Bank also offers to lend you the $50,000, but it will charge an annual rate of 7.0%, with no interest due until the end of the year. How much higher or lower is the effective annual rate charged by Midwest versus the rate charged by Riverside?

A) 0.52%

B) 0.44%

C) 0.36%

D) 0.30%

E) 0.24%

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your father is about to retire, and he wants to buy an annuity that will provide him with $85,000 of income a year for 25 years, with the first payment coming immediately. The going rate on such annuities is 5.15%. How much would it cost him to buy the annuity today?

A) $1,063,968

B) $1,119,966

C) $1,178,912

D) $1,240,960

E) $1,303,008

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If a bank compounds savings accounts quarterly, the nominal rate will exceed the effective annual rate.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You plan to analyze the value of a potential investment by calculating the sum of the present values of its expected cash flows. Which of the following would increase the calculated value of the investment?

A) The cash flows are in the form of a deferred annuity, and they total to $100,000. You learn that the annuity lasts for 10 years rather than 5 years, hence that each payment is for $10,000 rather than for $20,000.

B) The discount rate decreases.

C) The riskiness of the investment's cash flows increases.

D) The total amount of cash flows remains the same, but more of the cash flows are received in the later years and less are received in the earlier years.

E) The discount rate increases.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A "growing annuity" is a cash flow stream that grows at a constant rate for a specified number of periods.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What's the present value of a perpetuity that pays $250 per year if the appropriate interest rate is 5%?

A) $4,750

B) $5,000

C) $5,250

D) $5,513

E) $5,788

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your uncle is about to retire, and he wants to buy an annuity that will provide him with $75,000 of income a year for 20 years, with the first payment coming immediately. The going rate on such annuities is 5.25%. How much would it cost him to buy the annuity today?

A) $825,835

B) $869,300

C) $915,052

D) $963,213

E) $1,011,374

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ten years ago, Spielberg Inc. earned $0.50 per share. Its earnings this year were $2.20. What was the growth rate in earnings per share (EPS) over the 10-year period?

A) 15.17%

B) 15.97%

C) 16.77%

D) 17.61%

E) 18.49%

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

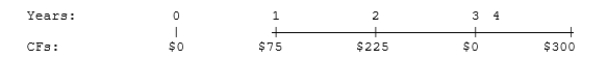

At a rate of 6.5%, what is the future value of the following cash flow stream?

A) $526.01

B) $553.69

C) $582.83

D) $613.51

E) $645.80

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that you own an annuity that will pay you $15,000 per year for 12 years, with the first payment being made today. You need money today to start a new business, and your uncle offers to give you $120,000 for the annuity. If you sell it, what rate of return would your uncle earn on his investment?

A) 6.85%

B) 7.21%

C) 7.59%

D) 7.99%

E) 8.41%

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You plan to borrow $35,000 at a 7.5% annual interest rate. The terms require you to amortize the loan with 7 equal end-of-year payments. How much interest would you be paying in Year 2?

A) $1,994.49

B) $2,099.46

C) $2,209.96

D) $2,326.27

E) $2,442.59

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 159

Related Exams