B) False

Correct Answer

verified

Correct Answer

verified

True/False

The owner of a convertible bond owns, in effect, both a bond and a call option.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements concerning warrants is CORRECT?

A) Bonds with warrants and convertible bonds both have option features that their holders can exercise if the underlying stock's price increases. However, if the option is exercised, the issuing company's debt declines if warrants were used but remains the same if it used convertibles.

B) Warrants are long-term put options that have value because holders can sell the firm's common stock at the exercise price regardless of how low the market price drops.

C) Warrants are long-term call options that have value because holders can buy the firm's common stock at the exercise price regardless of how high the stock's price has risen.

D) A firm's investors would generally prefer to see it issue bonds with warrants than straight bonds because the warrants dilute the value of new shareholders, and that value is transferred to existing shareholders.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

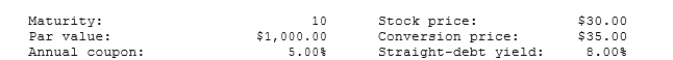

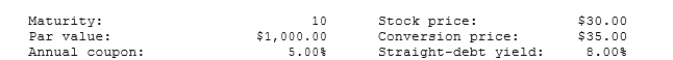

(The following data apply to Problems 27 through 30. The problems MUST be kept together.)

The following data apply to Saunders Corporation's convertible bonds:  -What is the bond's conversion ratio?

-What is the bond's conversion ratio?

A) 27.14

B) 28.57

C) 30.00

D) 31.50

E) 33.08

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

(The following data apply to Problems 27 through 30. The problems MUST be kept together.)

The following data apply to Saunders Corporation's convertible bonds:  -What is the bond's straight-debt value?

-What is the bond's straight-debt value?

A) $684.78

B) $720.82

C) $758.76

D) $798.70

E) $838.63

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Warren Corporation's stock sells for $42 per share. The company wants to sell some 20-year, annual interest, $1,000 par value bonds. Each bond would have 75 warrants attached to it, each exercisable into one share of stock at an exercise price of $47. The firm's straight bonds yield 10%. Each warrant is expected to have a market value of $2.00 given that the stock sells for $42. What coupon interest rate must the company set on the bonds in order to sell the bonds-with-warrants at par?

A) 7.83%

B) 8.24%

C) 8.65%

D) 9.08%

E) 9.54%

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

A convertible debenture can never sell for more than its conversion value or less than its bond value.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Its investment bankers have told Donner Corporation that it can issue a 25-year, 8.1% annual payment bond at par. They also stated that the company can sell an issue of annual payment preferred stock to corporate investors who are in the 40% tax bracket. The corporate investors require an after-tax return on the preferred that exceeds their after-tax return on the bonds by 1.0%, which would represent an after-tax risk premium. What coupon rate must be set on the preferred in order to issue it at par?

A) 6.66%

B) 6.99%

C) 7.34%

D) 7.71%

E) 8.09%

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Corporations that invest surplus funds in floating-rate preferred stock benefit from getting a relatively stable price, which is desirable for liquidity portfolios, and they also benefit from the 70% tax exemption on preferred dividends received.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A warrant is an option, and as such it cannot be used as a "sweetener."

B) False

Correct Answer

verified

Correct Answer

verified

Showing 21 - 30 of 30

Related Exams