B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Net working capital is defined as current assets minus the sum of payables and accruals, and any increase in the current ratio automatically indicates that net working capital has increased.

B) Although short-term interest rates have historically averaged less than long-term rates, the heavy use of short-term debt is considered to be an aggressive strategy because of the inherent risks associated with using short-term financing.

C) If a company follows a policy of "matching maturities," this means that it matches its use of common stock with its use of long-term debt as opposed to short-term debt.

D) Net working capital is defined as current assets minus the sum of payables and accruals, and any decrease in the current ratio automatically indicates that net working capital has decreased.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

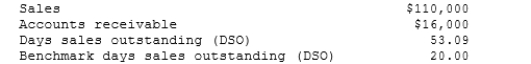

Data on Shick Inc. for 2008 are shown below, along with the days sales outstanding of the firms against which it benchmarks. The firm's new CFO believes that the company could reduce its receivables enough to reduce its DSO to the benchmarks' average. If this were done, by how much would receivables decline? Use a 365-day year.

A) $ 8,078

B) $ 8,975

C) $ 9,973

D) $10,970

E) $12,067

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

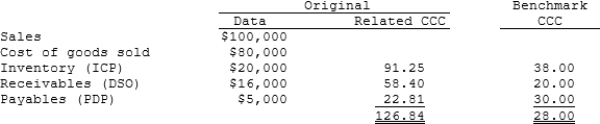

Soenen Inc. had the following data for 2008 (in millions) . The new CFO believes that the company could improve its working capital management sufficiently to bring its NWC and CCC up to the benchmark companies' level without affecting either sales or the costs of goods sold. Soenen finances its net working capital with a bank loan at an 8% annual interest rate, and it uses a 365-day year. If these changes had been made, by how much would the firm's pre-tax income have increased?

A) 1,901

B) 2,092

C) 2,301

D) 2,531

E) 2,784

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) A firm that makes 90% of its sales on credit and 10% for cash is growing at a constant rate of 10% annually. Such a firm will be able to keep its accounts receivable at the current level, since the 10% cash sales can be used to finance the 10% growth rate.

B) In managing a firm's accounts receivable, it is possible to increase credit sales per day yet still keep accounts receivable fairly steady, provided the firm can shorten the length of its collection period (its DSO) sufficiently.

C) Because of the costs of granting credit, it is not possible for credit sales to be more profitable than cash sales.

D) Since receivables and payables both result from sales transactions, a firm with a high receivables-to-sales ratio must also have a high payables-to-sales ratio.

E) Other things held constant, if a firm can shorten its DSO, this will lead to a higher current ratio.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Nogueiras Corp's budgeted monthly sales are $5,000, and they are constant from month to month. 40% of its customers pay in the first month and take the 2% discount, while the remaining 60% pay in the month following the sale and do not receive a discount. The firm has no bad debts. Purchases for next month's sales are constant at 50% of projected sales for the next month. "Other payments," which include wages, rent, and taxes, are 25% of sales for the current month. Construct a cash budget for a typical month and calculate the average net cash flow during the month.

A) $1,092

B) $1,150

C) $1,210

D) $1,271

E) $1,334

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The calculated cost of trade credit for a firm that buys on terms of 2/10 net 30 is lower (other things held constant) if the firm plans to pay in 40 days than in 30 days.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Changes in a firm's collection policy can affect sales, working capital, and profits.

B) False

Correct Answer

verified

True

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Accruals are an expensive but commonly used way to finance working capital.

B) A conservative financing policy is one where the firm finances part of its fixed assets with short-term capital and all of its net working capital with short-term funds.

C) If a company receives trade credit under terms of 2/10 net 30, this implies that the company has 10 days of free trade credit.

D) One cannot tell if a firm has a conservative, aggressive, or moderate current asset financing policy without an examination of its cash budget.

E) If a firm has a relatively aggressive current asset financing policy vis-à-vis other firms in its industry, then its current ratio will probably be relatively high.

Problems

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Halka Company is a no-growth firm. Its sales fluctuate seasonally, causing total assets to vary from $320,000 to $410,000, but fixed assets remain constant at $260,000. If the firm follows a maturity matching (or moderate) working capital financing policy, what is the most likely total of long-term debt plus equity capital?

A) $260,642

B) $274,360

C) $288,800

D) $304,000

E) $320,000

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Loans from commercial banks generally appear on balance sheets as notes payable. A bank's importance is actually greater than it appears from the dollar amounts shown on balance sheets because banks provide nonspontaneous funds to firms.

B) False

Correct Answer

verified

True

Correct Answer

verified

True/False

Suppose a firm changes its credit policy from 2/10 net 30 to 3/10 net 30. The change is meant to meet competition, so no increase in sales is expected. The average accounts receivable balance will probably decline as a result of this change.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The calculated cost of trade credit can be reduced by paying late.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Short-term marketable securities are held for two separate and distinct purposes: (1) to provide liquidity as a substitute for cash and (2) as a non-operating investment. Marketable securities held while awaiting reinvestment are not available for liquidity purposes.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statement completions is CORRECT? If the yield curve is upward sloping, then the marketable securities held in a firm's portfolio, assumed to be held for emergencies, should

A) consist mainly of long-term securities because they pay higher rates.

B) consist mainly of short-term securities because they pay higher rates.

C) consist mainly of U.S. Treasury securities to minimize interest rate risk.

D) consist mainly of short-term securities to minimize interest rate risk.

E) be balanced between long- and short-term securities to minimize the adverse effects of either an upward or a downward trend in interest rates.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cass & Company has the following data. What is the firm's cash conversion cycle? Inventory conversion period = 50 days Average collection period = 17 days Payables deferral period = 25 days

A) 31 days

B) 34 days

C) 38 days

D) 42 days

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A lockbox plan is most beneficial to firms that

A) have suppliers who operate in many different parts of the country.

B) have widely dispersed manufacturing facilities.

C) have a large marketable securities portfolio and cash to protect.

D) receive payments in the form of currency, such as fast food restaurants, rather than in the form of checks.

E) have customers who operate in many different parts of the country.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

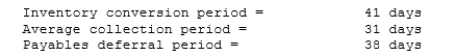

Whittington Inc. has the following data. What is the firm's cash conversion cycle?

A) 31 days

B) 34 days

C) 37 days

D) 41 days

E) 45 days

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Buskirk Construction buys on terms of 2/15, net 60 days. It does not take discounts, and it typically pays on time, 60 days after the invoice date. Net purchases amount to $450,000 per year. On average, how much "free" trade credit does the firm receive during the year? (Assume a 365-day year, and note that purchases are net of discounts.)

A) $18,493

B) $19,418

C) $20,389

D) $21,408

E) $22,479

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Edwards Enterprises follows a moderate current asset investment policy, but it is now considering a change, perhaps to a restricted or maybe to a relaxed policy. The firm's annual sales are $400,000; its fixed assets are $100,000; its target capital structure calls for 50% debt and 50% equity; its EBIT is $35,000; the interest rate on its debt is 10%; and its tax rate is 40%. With a restricted policy, current assets will be 15% of sales, while under a relaxed policy they will be 25% of sales. What is the difference in the projected ROEs between the restricted and relaxed policies?

A) 4.25%

B) 4.73%

C) 5.25%

D) 5.78%

E) 6.35%

G) A) and E)

Correct Answer

verified

C

Correct Answer

verified

Showing 1 - 20 of 128

Related Exams