A) If you found a stock with a zero historical beta and held it as the only stock in your portfolio, you would by definition have a riskless portfolio.

B) The beta coefficient of a stock is normally found by regressing past returns on a stock against past market returns. One could also construct a scatter diagram of returns on the stock versus those on the market, estimate the slope of the line of best fit, and use it as beta. However, this historical beta may differ from the beta that exists in the future.

C) The beta of a portfolio of stocks is always larger than the betas of any of the individual stocks.

D) It is theoretically possible for a stock to have a beta of 1.0. If a stock did have a beta of 1.0, then, at least in theory, its required rate of return would be equal to the risk-free (default-free) rate of return, rRF.

E) The beta of a portfolio of stocks is always smaller than the betas of any of the individual stocks.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

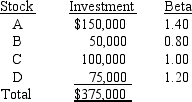

Paul McLaren holds the following portfolio:  Paul plans to sell Stock A and replace it with Stock E,which has a beta of 0.75.By how much will the portfolio beta change?

Paul plans to sell Stock A and replace it with Stock E,which has a beta of 0.75.By how much will the portfolio beta change?

A) -0.190

B) -0.211

C) -0.234

D) -0.260

E) -0.286

G) A) and C)

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

Joel Foster is the portfolio manager of the SF Fund,a $3 million hedge fund that contains the following stocks.The required rate of return on the market is 11.00% and the risk-free rate is 5.00%.What rate of return should investors expect (and require) on this fund?

A) 10.56%

B) 10.83%

C) 11.11%

D) 11.38%

E) 11.67%

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The CAPM is a multi-period model that takes account of differences in securities' maturities,and it can be used to determine the required rate of return for any given level of systematic risk.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Gardner Electric has a beta of 0.88 and an expected dividend growth rate of 4.00% per year.The T-bill rate is 4.00%,and the T-bond rate is 5.25%.The annual return on the stock market during the past 4 years was 10.25%.Investors expect the average annual future return on the market to be 12.50%.Using the SML,what is the firm's required rate of return?

A) 11.34%

B) 11.63%

C) 11.92%

D) 12.22%

E) 12.52%

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The slope of the SML is determined by investors' aversion to risk.The greater the average investor's risk aversion,the steeper the SML.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Recession,inflation,and high interest rates are economic events that are best characterized as being

A) company-specific risk factors that can be diversified away.

B) among the factors that are responsible for market risk.

C) risks that are beyond the control of investors and thus should not be considered by security analysts or portfolio managers.

D) irrelevant except to governmental authorities like the Federal Reserve.

E) systematic risk factors that can be diversified away.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Risk-averse investors require higher rates of return on investments whose returns are highly uncertain,and most investors are risk averse.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stock A has a beta of 0.8,Stock B has a beta of 1.0,and Stock C has a beta of 1.2.Portfolio P has 1/3 of its value invested in each stock.Each stock has a standard deviation of 25%,and their returns are independent of one another,i.e.,the correlation coefficients between each pair of stocks is zero.Assuming the market is in equilibrium,which of the following statements is CORRECT?

A) Portfolio P's expected return is equal to the expected return on Stock A.

B) Portfolio P's expected return is less than the expected return on Stock B.

C) Portfolio P's expected return is equal to the expected return on Stock B.

D) Portfolio P's expected return is greater than the expected return on Stock C.

E) Portfolio P's expected return is greater than the expected return on Stock B.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Assume that two investors each hold a portfolio,and that portfolio is their only asset.Investor A's portfolio has a beta of minus 2.0,while Investor B's portfolio has a beta of plus 2.0.Assuming that the unsystematic risks of the stocks in the two portfolios are the same,then the two investors face the same amount of risk.However,the holders of either portfolio could lower their risks,and by exactly the same amount,by adding some "normal" stocks with beta = 1.0.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The risk-free rate is 6%; Stock A has a beta of 1.0; Stock B has a beta of 2.0; and the market risk premium,rM - rRF,is positive.Which of the following statements is CORRECT?

A) Stock B's required rate of return is twice that of Stock A.

B) If Stock A's required return is 11%, then the market risk premium is 5%.

C) If Stock B's required return is 11%, then the market risk premium is 5%.

D) If the risk-free rate remains constant but the market risk premium increases, Stock A's required return will increase by more than Stock B's.

E) If the risk-free rate increases but the market risk premium stays unchanged, Stock B's required return will increase by more than Stock A's.

G) B) and D)

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

Stock LB has a beta of 0.5 and Stock HB has a beta of 1.5.The market is in equilibrium,with required returns equaling expected returns.Which of the following statements is CORRECT?

A) If both expected inflation and the market risk premium (rM -rRF) increase, the required return on Stock HB will increase by more than that on Stock LB.

B) If both expected inflation and the market risk premium (rM -rRF) increase, the required returns of both stocks will increase by the same amount.

C) Since the market is in equilibrium, the required returns of the two stocks should be the same.

D) If expected inflation remains constant but the market risk premium (rM - rRF) declines, the required return of Stock HB will decline but the required return of Stock LB will increase.

E) If expected inflation remains constant but the market risk premium (rM - rRF) declines, the required return of Stock LB will decline but the required return of Stock HB will increase.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bloome Co.'s stock has a 25% chance of producing a 30% return,a 50% chance of producing a 12% return,and a 25% chance of producing a -18% return.What is the firm's expected rate of return?

A) 7.72%

B) 8.12%

C) 8.55%

D) 9.00%

E) 9.50%

G) B) and E)

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

Gretta's portfolio consists of $700,000 invested in a stock that has a beta of 1.2 and $300,000 invested in a stock that has a beta of 0.8.The risk-free rate is 6% and the market risk premium is 5%.Which of the following statements is CORRECT?

A) The required return on the market is 10%.

B) The portfolio's required return is less than 11%.

C) If the risk-free rate remains unchanged but the market risk premium increases by 2%, Gretta's portfolio's required return will increase by more than 2%.

D) If the market risk premium remains unchanged but expected inflation increases by 2%, Gretta's portfolio's required return will increase by more than 2%.

E) If the stock market is efficient, Gretta's portfolio's expected return should equal the expected return on the market, which is 11%.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is NOT a potential problem when estimating and using betas,i.e.,which statement is FALSE?

A) Sometimes, during a period when the company is undergoing a change such as toward more leverage or riskier assets, the calculated beta will be drastically different from the "true" or "expected future" beta.

B) The beta of an "average stock," or "the market," can change over time, sometimes drastically.

C) Sometimes the past data used to calculate beta do not reflect the likely risk of the firm for the future because conditions have changed.

D) All of the statements above are true.

E) The fact that a security or project may not have a past history that can be used as the basis for calculating beta.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Porter Plumbing's stock had a required return of 11.75% last year,when the risk-free rate was 5.50% and the market risk premium was 4.75%.Then an increase in investor risk aversion caused the market risk premium to rise by 2%.The risk-free rate and the firm's beta remain unchanged.What is the company's new required rate of return? (Hint: First calculate the beta,then find the required return.)

A) 14.38%

B) 14.74%

C) 15.11%

D) 15.49%

E) 15.87%

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Variance is a measure of the variability of returns,and since it involves squaring the deviation of each actual return from the expected return,it is always larger than its square root,its standard deviation.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Managers should under no conditions take actions that increase their firm's risk relative to the market,regardless of how much those actions would increase the firm's expected rate of return.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The SML relates required returns to firms' systematic (or market)risk.The slope and intercept of this line can be influenced by a manager's actions.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is most likely to be true for a portfolio of 40 randomly selected stocks?

A) The riskiness of the portfolio is the same as the riskiness of each stock if it was held in isolation.

B) The beta of the portfolio is less than the average of the betas of the individual stocks.

C) The beta of the portfolio is equal to the average of the betas of the individual stocks.

D) The beta of the portfolio is larger than the average of the betas of the individual stocks.

E) The riskiness of the portfolio is greater than the riskiness of each of the stocks if each was held in isolation.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 146

Related Exams