A) an increase in a firm's debt ratio, with no changes in its sales or operating costs, could be expected to lower the profit margin.

B) the ratio of long-term debt to total capital is more likely to experience seasonal fluctuations than is either the dso or the inventory turnover ratio.

C) if two firms have the same roa, the firm with the most debt can be expected to have the lower roe.

D) an increase in the dso, other things held constant, could be expected to increase the total assets turnover ratio.

E) an increase in the dso, other things held constant, could be expected to increase the roe.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) if a firm increases its sales and cost of goods sold while holding its inventories constant, then, other things held constant, its inventory turnover ratio will decrease.

B) a reduction in inventories held would have no effect on the current ratio.

C) an increase in inventories would have no effect on the current ratio.

D) if a firm increases its sales and cost of goods sold while holding its inventories constant, then, other things held constant, its inventory turnover ratio will increase.

E) a reduction in the inventory turnover ratio will generally lead to an increase in the roe.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) suppose a firm's total assets turnover ratio falls from 1.0 to 0.9, but at the same time its profit margin rises from 9% to 10%, and its debt increases from 40% of total assets to 60%. under these conditions, the roe will decrease.

B) suppose a firm's total assets turnover ratio falls from 1.0 to 0.9, but at the same time its profit margin rises from 9% to 10% and its debt increases from 40% of total assets to 60%. under these conditions, the roe will increase.

C) suppose a firm's total assets turnover ratio falls from 1.0 to 0.9, but at the same time its profit margin rises from 9% to 10% and its debt increases from 40% of total assets to 60%. without additional information, we cannot tell what will happen to the roe.

D) the modified dupont equation provides information about how operations affect the roe, but the equation does not include the effects of debt on the roe.

E) other things held constant, an increase in the debt ratio will result in an increase in the profit margin on sales.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

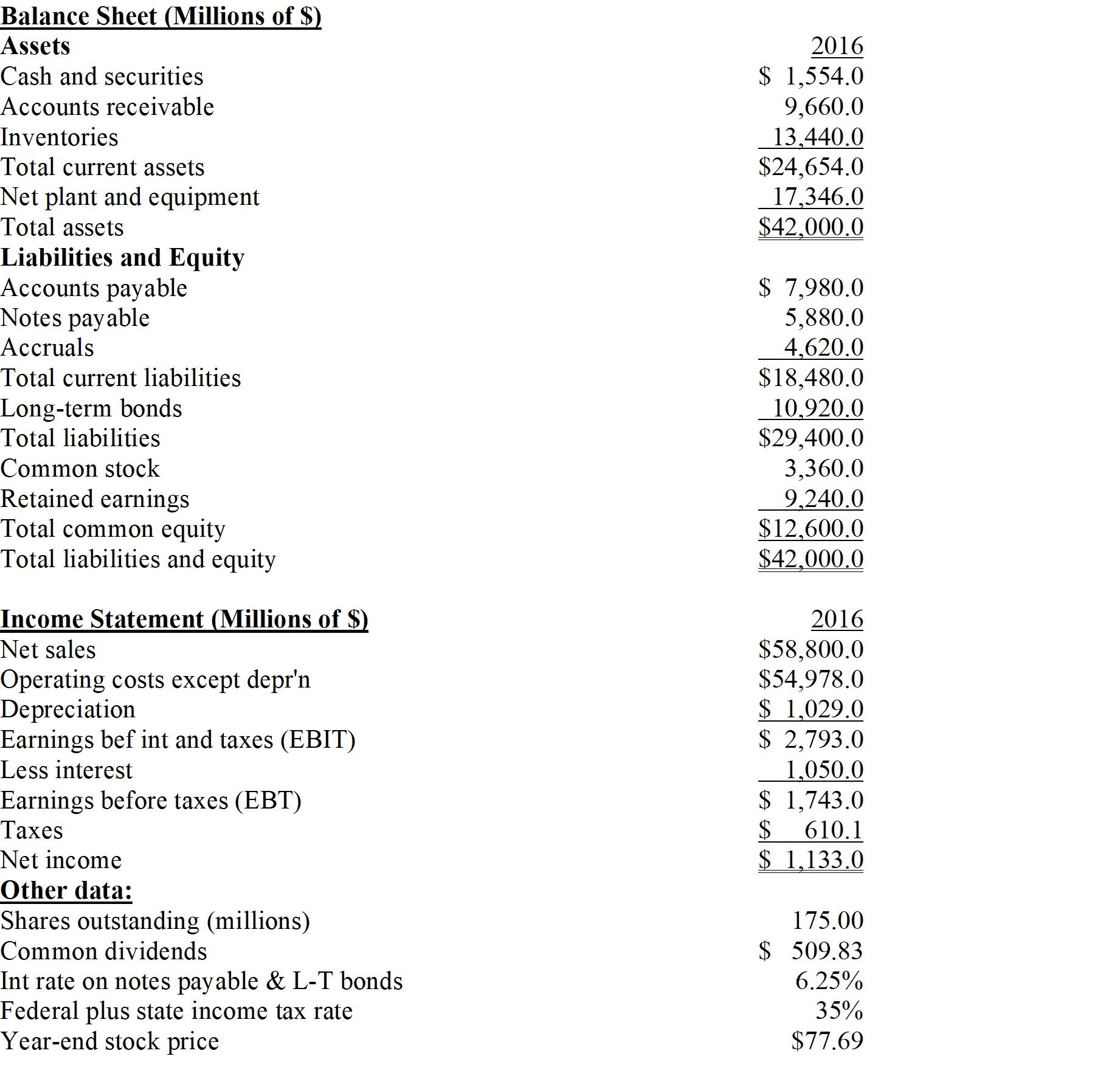

Pettijohn Inc.

The balance sheet and income statement shown below are for Pettijohn Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

-Refer to the data for Pettijohn Inc.What is the firm's ROA?

-Refer to the data for Pettijohn Inc.What is the firm's ROA?

A) 2.70%

B) 2.97%

C) 3.26%

D) 3.59%

E) 3.95%

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would indicate an improvement in a company's financial position, holding other things constant?

A) the current and quick ratios both increase.

B) the inventory and total assets turnover ratios both decline.

C) the debt ratio increases.

D) the profit margin declines.

E) the ebitda coverage ratio declines.

G) A) and B)

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) "window dressing" is any action that improves a firm's fundamental, long-run position and thus increases its intrinsic value.

B) borrowing by using short-term notes payable and then using the proceeds to retire long-term debt is an example of "window dressing." offering discounts to customers who pay with cash rather than buy on credit and then using the funds that come in quicker to purchase additional inventories is another example of "window dressing."

C) borrowing on a long-term basis and using the proceeds to retire short-term debt would improve the current ratio and thus could be considered to be an example of "window dressing."

D) offering discounts to customers who pay with cash rather than buy on credit and then using the funds that come in quicker to purchase additional inventories is an example of "window dressing."

E) using some of the firm's cash to reduce long-term debt is an example of "window dressing."

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

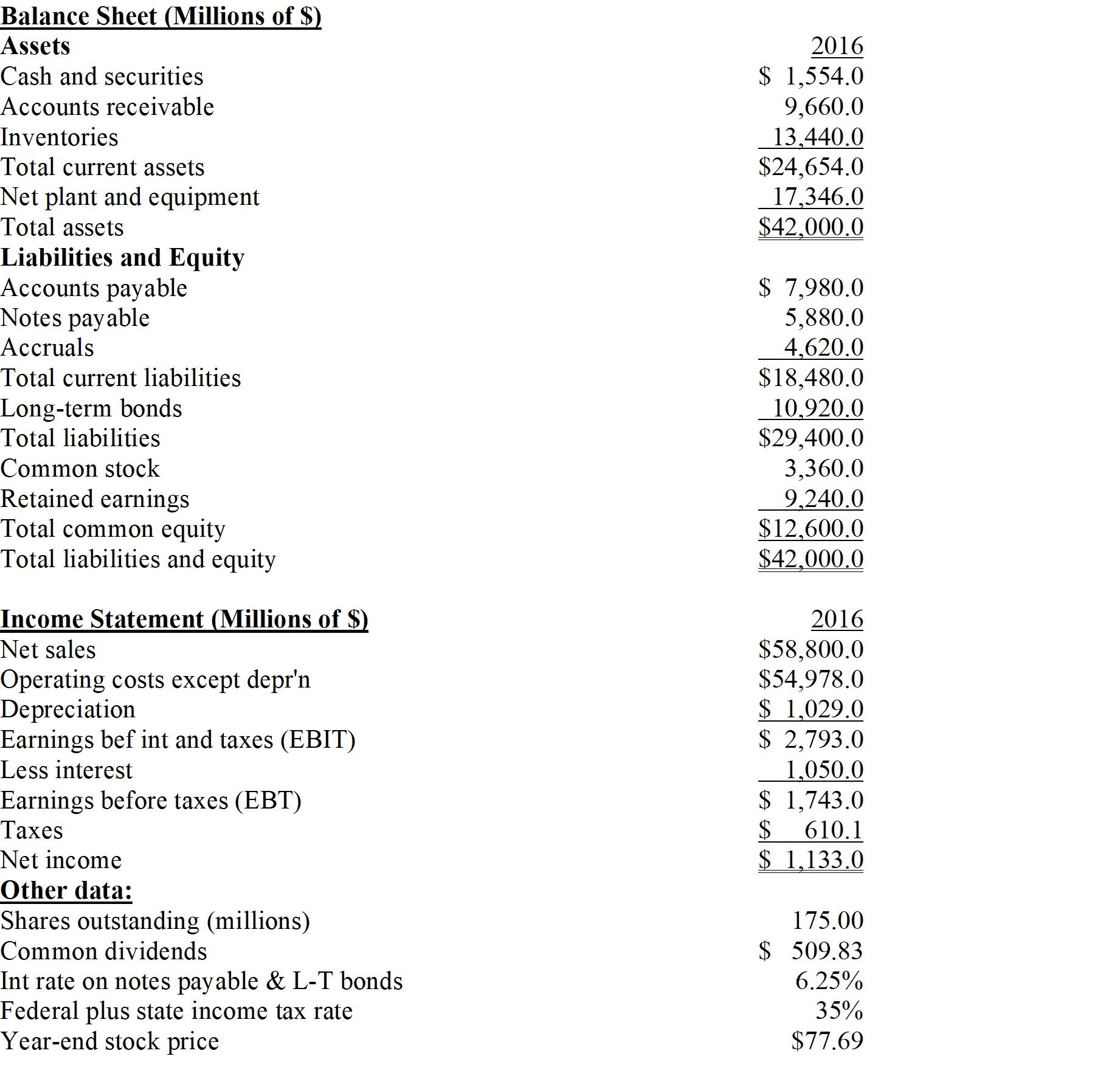

Pettijohn Inc.

The balance sheet and income statement shown below are for Pettijohn Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

-Refer to the data for Pettijohn Inc.What is the firm's dividends per share?

-Refer to the data for Pettijohn Inc.What is the firm's dividends per share?

A) $2.62

B) $2.91

C) $3.20

D) $3.53

E) $3.88

G) A) and C)

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

Lofland's has $20 million in current assets and $10 million in current liabilities, while Smaland's current assets are $10 million versus $20 million of current liabilities. Both firms would like to "window dress" their end-of-year financial statements, and to do so each plans to borrow $10 million on a short-term basis and to then hold the borrowed funds in their cash accounts. Which of the statements below best describes the results of these transactions?

A) the transaction would improve both firms' financial strength as measured by their current ratios.

B) the transactions would raise lofland's financial strength as measured by its current ratio but lower smaland's current ratio.

C) the transactions would lower lofland's financial strength as measured by its current ratio but raise smaland's current ratio.

D) the transaction would have no effect on the firm' financial strength as measured by their current ratios.

E) the transaction would lower both firm' financial strength as measured by their current ratios.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Since the ROA measures the firm's effective utilization of assets (without considering how these assets are financed), two firms with the same EBIT must have the same ROA.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Last year Central Chemicals had sales of $205,000, assets of $127,500, a profit margin of 5.3%, and an equity multiplier of 1.2. The CFO believes that the company could reduce its assets by $21,000 without affecting either sales or costs. Had it reduced its assets in this amount, and had the debt-to-assets ratio, sales, and costs remained constant, by how much would the ROE have changed?

A) 1.81%

B) 2.02%

C) 2.22%

D) 2.44%

E) 2.68%

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

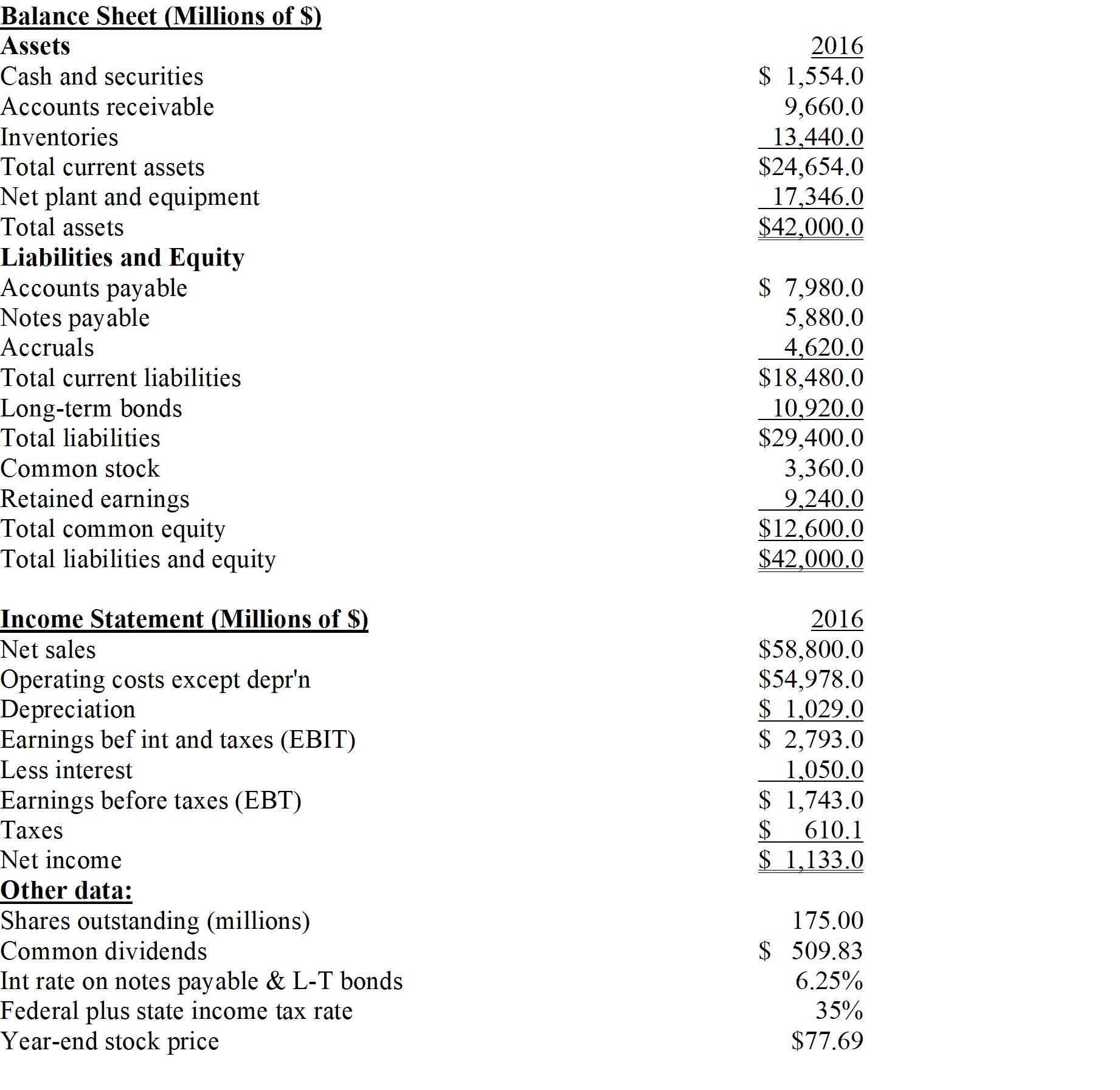

Pettijohn Inc.

The balance sheet and income statement shown below are for Pettijohn Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

-Refer to the data for Pettijohn Inc.What is the firm's P/E ratio?

-Refer to the data for Pettijohn Inc.What is the firm's P/E ratio?

A) 12.0

B) 12.6

C) 13.2

D) 13.9

E) 14.6

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ziebart Corp.'s EBITDA last year was $390,000 ( = EBIT + depreciation + amortization) , its interest charges were $9,500, it had to repay $26,000 of long-term debt, and it had to make a payment of $17,400 under a long-term lease. The firm had no amortization charges. What was the EBITDA coverage ratio?

A) 7.32

B) 7.70

C) 8.09

D) 8.49

E) 8.92

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

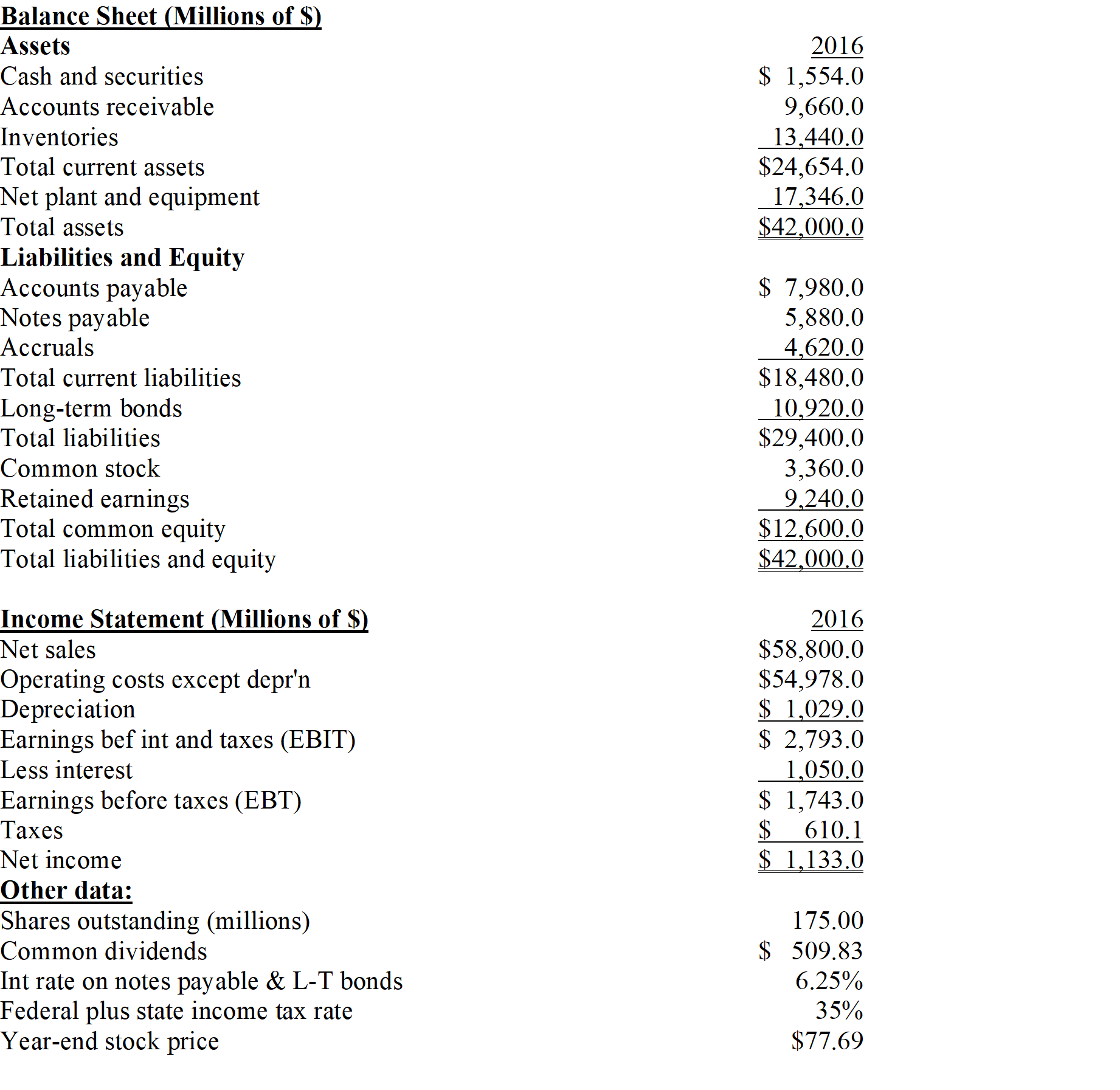

Pettijohn Inc.

The balance sheet and income statement shown below are for Pettijohn Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

-Refer to the data for Pettijohn Inc.What is the firm's equity multiplier?

-Refer to the data for Pettijohn Inc.What is the firm's equity multiplier?

A) 3.33

B) 3.50

C) 3.68

D) 3.86

E) 4.05

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Last year Altman Corp. had $205,000 of assets, $303,500 of sales, $18,250 of net income, and a debt-to-total-assets ratio of 41%. The new CFO believes the firm has excessive fixed assets and inventory that could be sold, enabling it to reduce its total assets to $152,500. Sales, costs, and net income would not be affected, and the firm would maintain the 41% debt ratio. By how much would the reduction in assets improve the ROE?

A) 4.69%

B) 4.93%

C) 5.19%

D) 5.45%

E) 5.73%

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A decline in a firm's inventory turnover ratio suggests that it is managing its inventory more efficiently and also that its liquidity position is improving, i.e., it is becoming more liquid.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Last year Urbana Corp. had $197,500 of assets, $307,500 of sales, $19,575 of net income, and a debt-to-total-assets ratio of 37.5%. The new CFO believes a new computer program will enable it to reduce costs and thus raise net income to $33,000. Assets, sales, and the debt ratio would not be affected. By how much would the cost reduction improve the ROE?

A) 9.32%

B) 9.82%

C) 10.33%

D) 10.88%

E) 11.42%

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An investor is considering starting a new business. The company would require $475,000 of assets, and it would be financed entirely with common stock. The investor will go forward only if she thinks the firm can provide a 13.5% return on the invested capital, which means that the firm must have an ROE of 13.5%. How much net income must be expected to warrant starting the business?

A) $52,230

B) $54,979

C) $57,873

D) $60,919

E) $64,125

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Market value ratios provide management with an indication of how investors view the firm's past performance and especially its future prospects.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Determining whether a firm's financial position is improving or deteriorating requires analyzing more than the ratios for a given year. Trend analysis is one method of measuring changes in a firm's performance over time.

B) False

Correct Answer

verified

True

Correct Answer

verified

Multiple Choice

Arshadi Corp.'s sales last year were $52,000, and its total assets were $22,000. What was its total assets turnover ratio (TATO) ?

A) 2.03

B) 2.13

C) 2.25

D) 2.36

E) 2.48

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 104

Related Exams