A) $1,537.69

B) $1,618.62

C) $1,699.55

D) $1,784.53

E) $1,873.76

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

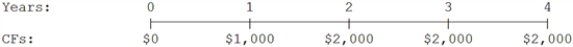

You sold your motorcycle and accepted a note with the following cash flow stream as your payment. What was the effective price you received for the car assuming an interest rate of 6.0%?

A) $5,987

B) $6,286

C) $6,600

D) $6,930

E) $7,277

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the PV of an ordinary annuity with 10 payments of $2,700 if the appropriate interest rate is 5.5%?

A) $16,576

B) $17,449

C) $18,367

D) $19,334

E) $20,352

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If some cash flows occur at the beginning of the periods while others occur at the ends, then we have what the textbook defines as a variable annuity.

B) The cash flows for an ordinary (or deferred) annuity all occur at the beginning of the periods.

C) If a series of unequal cash flows occurs at regular intervals, such as once a year, then the series is by definition an annuity.

D) The cash flows for an annuity due must all occur at the ends of the periods.

E) The cash flows for an annuity must all be equal, and they must occur at regular intervals, such as once a year or once a month.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose your credit card issuer states that it charges a 15.00% nominal annual rate, but you must make monthly payments, which amounts to monthly compounding. What is the effective annual rate?

A) 15.27%

B) 16.08%

C) 16.88%

D) 17.72%

E) 18.61%

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the PV of an ordinary annuity with 5 payments of $4,700 if the appropriate interest rate is 4.5%?

A) $16,806

B) $17,690

C) $18,621

D) $19,601

E) $20,633

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the PV of an annuity due with 5 payments of $2,500 at an interest rate of 5.5%?

A) $11,262.88

B) $11,826.02

C) $12,417.32

D) $13,038.19

E) $13,690.10

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are considering two equally risky annuities, each of which pays $15,000 per year for 20 years. Investment ORD is an ordinary (or deferred) annuity, while Investment DUE is an annuity due. Which of the following statements is CORRECT?

A) If the going rate of interest decreases from 10% to 0%, the difference between the present value of ORD and the present value of DUE would remain constant.

B) The present value of ORD must exceed the present value of DUE, but the future value of ORD may be less than the future value of DUE.

C) The present value of DUE exceeds the present value of ORD, while the future value of DUE is less than the future value of ORD.

D) The present value of ORD exceeds the present value of DUE, and the future value of ORD also exceeds the future value of DUE.

E) The present value of DUE exceeds the present value of ORD, and the future value of DUE also exceeds the future value of ORD.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You plan to analyze the value of a potential investment by calculating the sum of the present values of its expected cash flows. Which of the following would lower the calculated value of the investment?

A) The discount rate decreases.

B) The cash flows are in the form of a deferred annuity, and they total to $100,000. You learn that the annuity lasts for only 5 rather than 10 years, hence that each payment is for $20,000 rather than for $10,000.

C) The discount rate increases.

D) The riskiness of the investment's cash flows decreases.

E) The total amount of cash flows remains the same, but more of the cash flows are received in the earlier years and less are received in the later years.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The greater the number of compounding periods within a year, then (1) the greater the future value of a lump sum investment at Time 0 and (2) the greater the present value of a given lump sum to be received at some future date.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At the end of 10 years, which of the following investments would have the highest future value? Assume that the effective annual rate for all investments is the same and is greater than zero.

A) Investment A pays $250 at the beginning of every year for the next 10 years (a total of 10 payments) .

B) Investment B pays $125 at the end of every 6-month period for the next 10 years (a total of 20 payments) .

C) Investment C pays $125 at the beginning of every 6-month period for the next 10 years (a total of 20 payments) .

D) Investment D pays $2,500 at the end of 10 years (just one payment) .

E) Investment E pays $250 at the end of every year for the next 10 years (a total of 10 payments) .

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Time lines cannot be constructed in situations where some of the cash flows occur annually but others occur quarterly.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are considering two equally risky annuities, each of which pays $25,000 per year for 10 years. Investment ORD is an ordinary (or deferred) annuity, while Investment DUE is an annuity due. Which of the following statements is CORRECT?

A) If the going rate of interest decreases from 10% to 0%, the difference between the present value of ORD and the present value of DUE would remain constant.

B) A rational investor would be willing to pay more for DUE than for ORD, so their market prices should differ.

C) The present value of DUE exceeds the present value of ORD, while the future value of DUE is less than the future value of ORD.

D) The present value of ORD exceeds the present value of DUE, and the future value of ORD also exceeds the future value of DUE.

E) The present value of ORD exceeds the present value of DUE, while the future value of DUE exceeds the future value of ORD.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Time lines can be constructed in situations where some of the cash flows occur annually but others occur quarterly.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Midway through the life of an amortized loan, the percentage of the payment that represents interest must be equal to the percentage that represents repayment of principal. This is true regardless of the original life of the loan or the interest rate on the loan.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your bank offers to lend you $100,000 at an 8.5% annual interest rate to start your new business. The terms require you to amortize the loan with 10 equal end-of-year payments. How much interest would you be paying in Year 2?

A) $7,531

B) $7,927

C) $8,323

D) $8,740

E) $9,177

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You would like to travel in South America 5 years from now, and you can save $3,100 per year, beginning one year from today. You plan to deposit the funds in a mutual fund that you think will return 8.5% per year. Under these conditions, how much would you have just after you make the 5th deposit, 5 years from now?

A) $18,369

B) $19,287

C) $20,251

D) $21,264

E) $22,327

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are considering investing in a European bank account that pays a nominal annual rate of 18%, compounded monthly. If you invest $5,000 at the beginning of each month, how many months would it take for your account to grow to $250,000? Round fractional months up.

A) 23

B) 27

C) 32

D) 38

E) 44

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

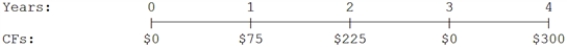

What is the present value of the following cash flow stream at a rate of 6.25%?

A) $411.57

B) $433.23

C) $456.03

D) $480.03

E) $505.30

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A $150,000 loan is to be amortized over 6 years, with annual end-of-year payments. Which of these statements is CORRECT?

A) The proportion of interest versus principal repayment would be the same for each of the 7 payments.

B) The annual payments would be larger if the interest rate were lower.

C) If the loan were amortized over 10 years rather than 6 years, and if the interest rate were the same in either case, the first payment would include more dollars of interest under the 6-year amortization plan.

D) The proportion of each payment that represents interest as opposed to repayment of principal would be higher if the interest rate were lower.

E) The proportion of each payment that represents interest versus repayment of principal would be higher if the interest rate were higher.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 168

Related Exams