A) If Firms X and Y have the same net income, number of shares outstanding, and price per share, then their market-to-book ratios must also be the same.

B) If Firms X and Y have the same P/E ratios, then their market-to-book ratios must also be the same.

C) If Firms X and Y have the same net income, number of shares outstanding, and price per share, then their P/E ratios must also be the same.

D) If Firms X and Y have the same earnings per share and market-to-book ratio, they must have the same price earnings ratio.

E) If Firm X's P/E ratio exceeds that of Firm Y, then Y is likely to be less risky and also to be expected to grow at a faster rate.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

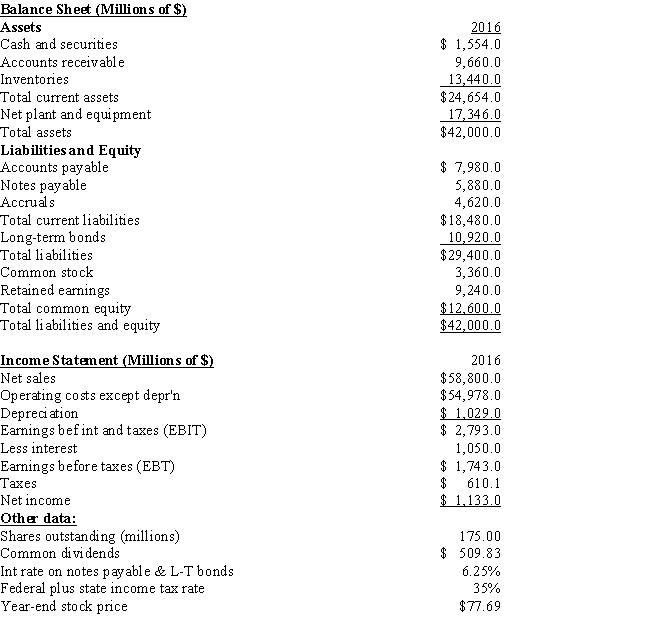

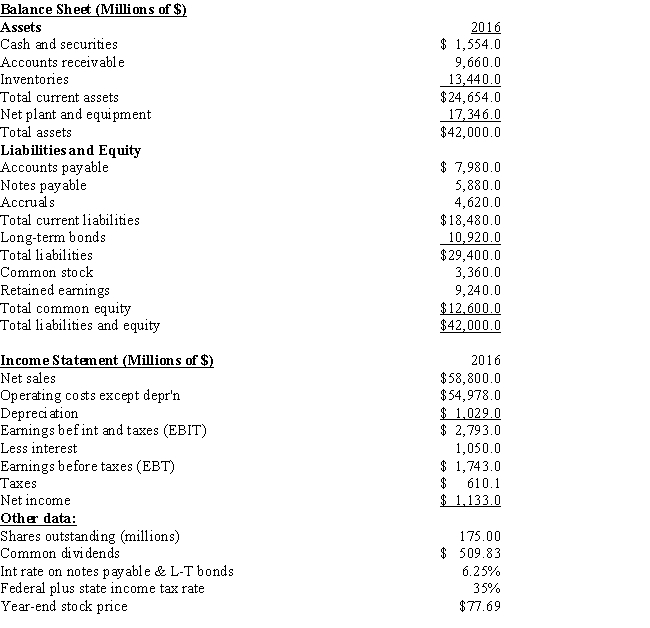

Pettijohn Inc.

The balance sheet and income statement shown below are for Pettijohn Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

-Refer to the data for Pettijohn Inc. What is the firm's equity multiplier?

-Refer to the data for Pettijohn Inc. What is the firm's equity multiplier?

A) 3.33

B) 3.50

C) 3.68

D) 3.86

E) 4.05

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) An increase in a firm's debt ratio, with no changes in its sales or operating costs, could be expected to lower the profit margin.

B) The ratio of long-term debt to total capital is more likely to experience seasonal fluctuations than is either the DSO or the inventory turnover ratio.

C) If two firms have the same ROA, the firm with the most debt can be expected to have the lower ROE.

D) An increase in the DSO, other things held constant, could be expected to increase the total assets turnover ratio.

E) An increase in the DSO, other things held constant, could be expected to increase the ROE.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Last year Vaughn Corp. had sales of $315,000 and a net income of $17,832, and its year-end assets were $210,000. The firm's total-debt-to-total-assets ratio was 42.5%. Based on the DuPont equation, what was Vaughn's ROE?

A) 14.77%

B) 15.51%

C) 16.28%

D) 17.10%

E) 17.95%

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Companies A and C each reported the same earnings per share (EPS) , but Company A's stock trades at a higher price. Which of the following statements is CORRECT?

A) Company A trades at a higher P/E ratio.

B) Company A probably has fewer growth opportunities.

C) Company A is probably judged by investors to be riskier.

D) Company A must have a higher market-to-book ratio.

E) Company A must pay a lower dividend.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Companies Heidee and Leaudy have the same total assets, sales, operating costs, and tax rates, and they pay the same interest rate on their debt. However, company Heidee has a higher debt ratio. Which of the following statements is CORRECT?

A) If the interest rate the companies pay on their debt is less than their basic earning power (BEP) , then Company Heidee will have the higher ROE.

B) Given this information, Leaudy must have the higher ROE.

C) Company Leaudy has a higher basic earning power ratio (BEP) .

D) Company Heidee has a higher basic earning power ratio (BEP) .

E) If the interest rate the companies pay on their debt is more than their basic earning power (BEP) , then Company Heidee will have the higher ROE.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Pettijohn Inc.

The balance sheet and income statement shown below are for Pettijohn Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

-Refer to the data for Pettijohn Inc. What is the firm's dividends per share?

-Refer to the data for Pettijohn Inc. What is the firm's dividends per share?

A) $2.62

B) $2.91

C) $3.20

D) $3.53

E) $3.88

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Hutchinson Corporation has zero debt⎯it is financed only with common equity. Its total assets are $410,000. The new CFO wants to employ enough debt to bring the debt/assets ratio to 40%, using the proceeds from the borrowing to buy back common stock at its book value. How much must the firm borrow to achieve the target debt ratio?

A) $155,800

B) $164,000

C) $172,200

D) $180,810

E) $189,851

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bostian, Inc. has total assets of $625,000. Its total debt outstanding is $185,000. The Board of Directors has directed the CFO to move towards a debt-to-assets ratio of 55%. How much debt must the company add or subtract to achieve the target debt ratio?

A) $158,750

B) $166,688

C) $175,022

D) $183,773

E) $192,962

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If a firm finances with only debt and common equity, and if its equity multiplier is 3.0, then its debt ratio must be 0.667.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

One problem with ratio analysis is that relationships can be manipulated. For example, if our current ratio is greater than 1.5, then borrowing on a short-term basis and using the funds to build up our cash account would cause the current ratio to increase.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would, generally, indicate an improvement in a company's financial position, holding other things constant?

A) The total assets turnover decreases.

B) The TIE declines.

C) The DSO increases.

D) The EBITDA coverage ratio increases.

E) The current and quick ratios both decline.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Branch Corp.'s total assets at the end of last year were $315,000 and its net income after taxes was $22,750. What was its return on total assets?

A) 7.22%

B) 7.58%

C) 7.96%

D) 8.36%

E) 8.78%

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cordelion Communications is considering issuing new common stock and using the proceeds to reduce its outstanding debt. The stock issue would have no effect on total assets, the interest rate Cordelion pays, EBIT, or the tax rate. Which of the following is likely to occur if the company goes ahead with the stock issue?

A) The times interest earned ratio will decrease.

B) The ROA will decline.

C) Taxable income will decrease.

D) The tax bill will increase.

E) Net income will decrease.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Even though Firm A's current ratio exceeds that of Firm B, Firm B's quick ratio might exceed that of A. However, if A's quick ratio exceeds B's, then we can be certain that A's current ratio is also larger than that of B.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would indicate an improvement in a company's financial position, holding other things constant?

A) The current and quick ratios both increase.

B) The inventory and total assets turnover ratios both decline.

C) The debt ratio increases.

D) The profit margin declines.

E) The EBITDA coverage ratio declines.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Heidee Corp. and Leaudy Corp. have identical assets, sales, interest rates paid on their debt, tax rates, and EBIT. However, Heidee uses more debt than Leaudy. Which of the following statements is CORRECT?

A) Heidee would have the higher net income as shown on the income statement.

B) Without more information, we cannot tell if Heidee or Leaudy would have a higher or lower net income.

C) Heidee would have the lower equity multiplier for use in the DuPont equation.

D) Heidee would have to pay more in income taxes.

E) Heidee would have the lower net income as shown on the income statement.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Vang Corp.'s stock price at the end of last year was $33.50 and its earnings per share for the year were $2.30. What was its P/E ratio?

A) 13.84

B) 14.57

C) 15.29

D) 16.06

E) 16.86

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Profitability ratios show the combined effects of liquidity, asset management, and debt management on operating results.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Lindley Corp.'s stock price at the end of last year was $33.50, and its book value per share was $25.00. What was its market/book ratio?

A) 1.34

B) 1.41

C) 1.48

D) 1.55

E) 1.63

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 104

Related Exams