B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Lofland's has $20 million in current assets and $10 million in current liabilities, while Smaland's current assets are $10 million versus $20 million of current liabilities. Both firms would like to "window dress" their end-of-year financial statements, and to do so each plans to borrow $10 million on a short-term basis and to then hold the borrowed funds in their cash accounts. Which of the statements below best describes the results of these transactions?

A) The transaction would improve both firms' financial strength as measured by their current ratios.

B) The transactions would raise Lofland's financial strength as measured by its current ratio but lower Smaland's current ratio.

C) The transactions would lower Lofland's financial strength as measured by its current ratio but raise Smaland's current ratio.

D) The transaction would have no effect on the firm' financial strength as measured by their current ratios.

E) The transaction would lower both firm' financial strength as measured by their current ratios.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Rappaport Corp.'s sales last year were $320,000, and its net income after taxes was $23,000. What was its profit margin on sales?

A) 6.49%

B) 6.83%

C) 7.19%

D) 7.55%

E) 7.92%

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

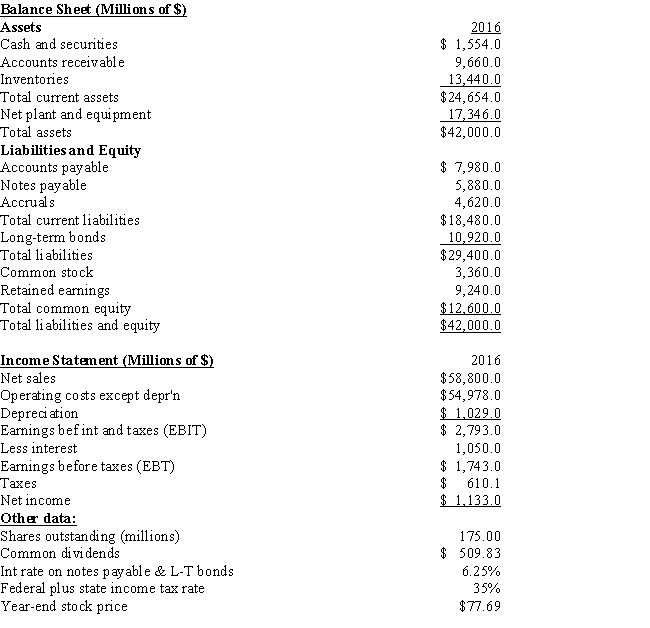

Pettijohn Inc.

The balance sheet and income statement shown below are for Pettijohn Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

-Refer to the data for Pettijohn Inc. What is the firm's days sales outstanding? Assume a 360-day year for this calculation.

-Refer to the data for Pettijohn Inc. What is the firm's days sales outstanding? Assume a 360-day year for this calculation.

A) 48.17

B) 50.71

C) 53.38

D) 56.19

E) 59.14

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 101 - 104 of 104

Related Exams