A) The company increases the percentage of equity in its target capital structure.

B) The number of profitable potential projects increases.

C) Congress lowers the tax rate on capital gains. The remainder of the tax code is not changed.

D) Earnings are unchanged, but the firm issues new shares of common stock.

E) The firm's net income increases.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Yesterday, Berryman Investments was selling for $90 per share. Today, the company completed a 7-for-2 stock split. If the total market value was unchanged by the split, what is the price of the stock today?

A) $23.21

B) $24.43

C) $25.71

D) $27.00

E) $28.35

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The announcement of an increase in the cash dividend should, according to MM, lead to an increase in the price of the firm's stock.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) One advantage of the residual dividend policy is that it leads to a stable dividend payout, which investors like.

B) An increase in the stock price when a company decreases its dividend is consistent with signaling theory as postulated by MM.

C) If the "clientele effect" is correct, then for a company whose earnings fluctuate, a policy of paying a constant percentage of net income will probably maximize the stock price.

D) Stock repurchases make the most sense at times when a company believes its stock is undervalued.

E) Firms with a lot of good investment opportunities and a relatively small amount of cash tend to have above average payout ratios.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The optimal distribution policy strikes that balance between current dividends and capital gains that maximizes the firm's stock price.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Harvey's Industrial Plumbing Supply's target capital structure consists of 40% debt and 60% equity. Its capital budget this year is forecast to be $650,000. It also wants to pay a dividend of $225,000. If the company follows the residual dividend policy, how much net income must it earn to meet its capital requirements, pay the dividend, and keep the capital structure in balance?

A) $584,250

B) $615,000

C) $645,750

D) $678,038

E) $711,939

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

David Rose Inc. forecasts a capital budget of $500,000 next year with forecasted net income of $400,000. The company wants to maintain a target capital structure of 30% debt and 70% equity. If the company follows the residual dividend policy, how much in dividends, if any, will it pay?

A) $42,869

B) $45,125

C) $47,500

D) $50,000

E) $52,500

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Grandin Inc. is evaluating its dividend policy. It has a capital budget of $625,000, and it wants to maintain a target capital structure of 60% debt and 40% equity. The company forecasts a net income of $475,000. If it follows the residual dividend policy, what is its forecasted dividend payout ratio?

A) 40.61%

B) 42.75%

C) 45.00%

D) 47.37%

E) 49.74%

G) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Underlying the dividend irrelevance theory proposed by Miller and Modigliani is their argument that the value of the firm is determined only by its basic earning power and its business risk.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The capital budget forecast for the Santano Company is $725,000. The CFO wants to maintain a target capital structure of 45% debt and 55% equity, and it also wants to pay dividends of $500,000. If the company follows the residual dividend policy, how much income must it earn, and what will its dividend payout ratio be? Net Income Payout

A) $ 898,750 55.63%

B) $ 943,688 58.41%

C) $ 990,872 61.34%

D) $1,040,415 64.40%

E) $1,092,436 67.62%

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Poff Industries' stock currently sells for $120 a share. You own 100 shares of the stock. The company is contemplating a 2-for-1 stock split. Which of the following best describes what your position will be after such a split takes place?

A) You will have 200 shares of stock, and the stock will trade at or near $60 a share.

B) You will have 100 shares of stock, and the stock will trade at or near $60 a share.

C) You will have 50 shares of stock, and the stock will trade at or near $120 a share.

D) You will have 50 shares of stock, and the stock will trade at or near $60 a share.

E) You will have 200 shares of stock, and the stock will trade at or near $120 a share.

G) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

If a firm adopts a residual distribution policy, distributions are determined as a residual after funding the capital budget. Therefore, the better the firm's investment opportunities, the lower its payout ratio should be.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

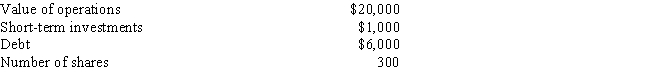

The following data apply to Elizabeth's Electrical Equipment: The company plans on distributing $1,000 by repurchasing stock. What will the intrinsic per share stock price be immediately after the repurchase?

A) $47.50

B) $50.00

C) $52.50

D) $55.13

E) $57.88

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In recent years Constable Inc. has suffered losses, and its stock currently sells for only $0.50 per share. Management wants to use a reverse split to get the price up to a more "reasonable" level, which it thinks is $25 per share. How many of the old shares must be given up for one new share to achieve the $25 price, assuming this transaction has no effect on total market value?

A) 47.50

B) 49.88

C) 50.00

D) 52.50

E) 55.13

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Getler Inc.'s projected capital budget is $2,000,000, its target capital structure is 40% debt and 60% equity, and its forecasted net income is $1,000,000. If the company follows a residual dividend policy, how much dividends will it pay or, alternatively, how much new stock must it issue? Dividends Stock Issued

A) $514,425 $162,901

B) $541,500 $171,475

C) $570,000 $180,500

D) $600,000 $190,000

E) $ 0 $200,000

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) One advantage of dividend reinvestment plans is that they enable investors to postpone paying taxes on the dividends credited to their account.

B) Stock repurchases can be used by a firm that wants to increase its debt ratio.

C) Stock repurchases make sense if a company expects to have a lot of profitable new projects to fund over the next few years, provided investors are aware of these investment opportunities.

D) One advantage of an open market dividend reinvestment plan is that it provides new equity capital and increases the shares outstanding.

E) One disadvantage of dividend reinvestment plans is that they increase transactions costs for investors who want to increase their ownership in the company.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be most likely to lead to a decrease in a firm's dividend payout ratio?

A) Its access to the capital markets increases.

B) Its R&D efforts pay off, and it now has more high-return investment opportunities.

C) Its accounts receivable decrease due to a change in its credit policy.

D) Its stock price has increased over the last year by a greater percentage than the increase in the broad stock market averages.

E) Its earnings become more stable.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

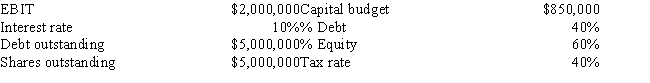

Silvana Inc. projects the following data for the coming year. If the firm follows the residual dividend policy and also maintains its target capital structure, what will its payout ratio be?

A) 37.2%

B) 39.1%

C) 41.2%

D) 43.3%

E) 45.5%

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 58 of 58

Related Exams