B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose a firm relies exclusively on the payback method when making capital budgeting decisions, and it sets a 4-year payback regardless of economic conditions. Other things held constant, which of the following statements is most likely to be true?

A) It will accept too many long-term projects and reject too many short-term projects (as judged by the NPV) .

B) The firm will accept too many projects in all economic states because a 4-year payback is too low.

C) The firm will accept too few projects in all economic states because a 4-year payback is too high.

D) If the 4-year payback results in accepting just the right set of projects under average economic conditions, then this payback will result in too few long-term projects when the economy is weak.

E) It will accept too many short-term projects and reject too many long-term projects (as judged by the NPV) .

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

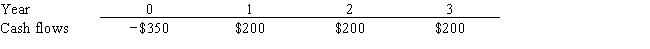

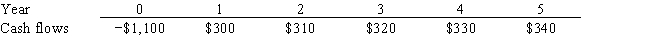

Garner Inc. is considering a project that has the following cash flow data. What is the project's payback?

A) 1.42 years

B) 1.58 years

C) 1.75 years

D) 1.93 years

E) 2.12 years

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT? Assume that all projects being considered have normal cash flows and are equally risky.

A) If a project's IRR is equal to its cost of capital, then under all reasonable conditions, the project's IRR must be negative.

B) If a project's IRR is equal to its cost of capital, then under all reasonable conditions the project's NPV must be zero.

C) There is no necessary relationship between a project's IRR, its cost of capital, and its NPV.

D) When evaluating mutually exclusive projects, those projects with relatively long lives will tend to have relatively high NPVs when the cost of capital is relatively high.

E) If a project's IRR is equal to its cost of capital, then, under all reasonable conditions, the project's NPV must be negative.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT? Assume that the project being considered has normal cash flows, with one outflow followed by a series of inflows.

A) A project's regular IRR is found by discounting the cash inflows at the cost of capital to find the present value (PV) , then compounding this PV to find the IRR.

B) If a project's IRR is greater than the WACC, then its NPV must be negative.

C) To find a project's IRR, we must solve for the discount rate that causes the PV of the inflows to equal the PV of the project's costs.

D) To find a project's IRR, we must find a discount rate that is equal to the cost of capital.

E) A project's regular IRR is found by compounding the cash inflows at the cost of capital to find the terminal value (TV) , then discounting this TV at the cost of capital.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT? Assume that the project being considered has normal cash flows, with one outflow followed by a series of inflows.

A) A project's regular IRR is found by compounding the cash inflows at the cost of capital to find the present value (PV) , then discounting the TV to find the IRR.

B) If a project's IRR is smaller than the cost of capital, then its NPV will be positive.

C) A project's IRR is the discount rate that causes the PV of the inflows to equal the project's cost.

D) If a project's IRR is positive, then its NPV must also be positive.

E) A project's regular IRR is found by compounding the initial cost at the cost of capital to find the terminal value (TV) , then discounting the TV at the cost of capital.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The cost of capital for two mutually exclusive projects that are being considered is 12%. Project K has an IRR of 20% while Project R's IRR is 15%. The projects have the same NPV at the 12% current cost of capital. Interest rates are currently high. However, you believe that money costs and thus your cost of capital will soon decline. You also think that the projects will not be funded until the cost of capital has decreased, and their cash flows will not be affected by the change in economic conditions. Under these conditions, which of the following statements is CORRECT?

A) You should delay a decision until you have more information on the projects, even if this means that a competitor might come in and capture this market.

B) You should recommend Project R, because at the new cost of capital it will have the higher NPV.

C) You should recommend Project K, because at the new cost of capital it will have the higher NPV.

D) You should recommend Project R because it will have both a higher IRR and a higher NPV under the new conditions.

E) You should reject both projects because they will both have negative NPVs under the new conditions.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

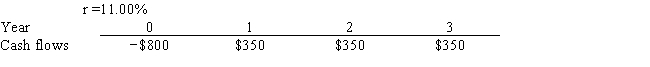

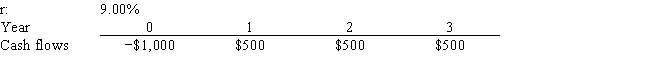

Wiley's Wire Products is considering a project that has the following cash flow and cost of capital (r) data. What is the project's MIRR? Note that a project's MIRR can be less than the cost of capital (and even negative) , in which case it will be rejected.

A) 8.86%

B) 9.84%

C) 10.94%

D) 12.15%

E) 13.50%

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

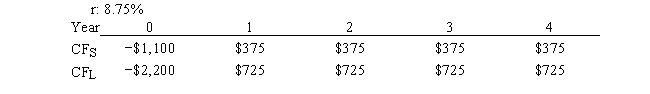

Silverman Co. is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. If the decision is made by choosing the project with the higher MIRR rather than the one with the higher NPV, how much value will be forgone? Note that under some conditions choosing projects on the basis of the MIRR will cause $0.00 value to be lost.

A) $32.12

B) $35.33

C) $38.87

D) $40.15

E) $42.16

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The internal rate of return is that discount rate that equates the present value of the cash outflows (or costs) with the present value of the cash inflows.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

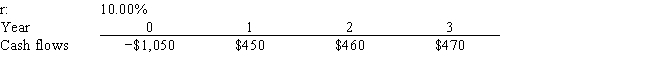

Reed Enterprises is considering a project that has the following cash flow and cost of capital (r) data. What is the project's NPV? Note that a project's expected NPV can be negative, in which case it will be rejected.

A) $92.37

B) $96.99

C) $101.84

D) $106.93

E) $112.28

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

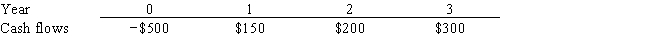

Suzanne's Cleaners is considering a project that has the following cash flow data. What is the project's payback?

A) 2.31 years

B) 2.56 years

C) 2.85 years

D) 3.16 years

E) 3.52 years

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Projects A and B are mutually exclusive and have normal cash flows. Project A has an IRR of 15% and B's IRR is 20%. The company's cost of capital is 12%, and at that rate Project A has the higher NPV. Which of the following statements is CORRECT?

A) Assuming the timing pattern of the two projects' cash flows is the same, Project B probably has a higher cost (and larger scale) .

B) Assuming the two projects have the same scale, Project B probably has a faster payback than Project A.

C) The crossover rate for the two projects must be 12%.

D) Since B has the higher IRR, then it must also have the higher NPV if the crossover rate is less than the cost of capital of 12%.

E) The crossover rate for the two projects must be less than 12%.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Normal Projects S and L have the same NPV when the discount rate is zero. However, Project S's cash flows come in faster than those of L. Therefore, we know that at any discount rate greater than zero, L will have the higher NPV.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT? Assume that the project being considered has normal cash flows, with one outflow followed by a series of inflows.

A) If Project A has a higher IRR than Project B, then Project A must also have a higher NPV.

B) The IRR calculation implicitly assumes that all cash flows are reinvested at the cost of capital.

C) The IRR calculation implicitly assumes that cash flows are withdrawn from the business rather than being reinvested in the business.

D) If a project has normal cash flows and its IRR exceeds its cost of capital, then the project's NPV must be positive.

E) If Project A has a higher IRR than Project B, then Project A must have the lower NPV.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) The NPV method assumes that cash flows will be reinvested at the risk-free rate, while the IRR method assumes reinvestment at the IRR.

B) The NPV method assumes that cash flows will be reinvested at the cost of capital, while the IRR method assumes reinvestment at the risk-free rate.

C) The NPV method does not consider all relevant cash flows, particularly cash flows beyond the payback period.

D) The IRR method does not consider all relevant cash flows, particularly cash flows beyond the payback period.

E) The NPV method assumes that cash flows will be reinvested at the cost of capital, while the IRR method assumes reinvestment at the IRR.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ellmann Systems is considering a project that has the following cash flow and cost of capital (r) data. What is the project's NPV? Note that if a project's expected NPV is negative, it should be rejected.

A) $265.65

B) $278.93

C) $292.88

D) $307.52

E) $322.90

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The IRR method is based on the assumption that projects' cash flows are reinvested at the project's risk-adjusted cost of capital.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Projects C and D both have normal cash flows and are mutually exclusive. Project C has a higher NPV if the cost of capital is less than 12%, whereas Project D has a higher NPV if the cost of capital exceeds 12%. Which of the following statements is CORRECT?

A) Project D is probably larger in scale than Project C.

B) Project C probably has a faster payback.

C) Project C probably has a higher IRR.

D) The crossover rate between the two projects is below 12%.

E) Project D probably has a higher IRR.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Worthington Inc. is considering a project that has the following cash flow data. What is the project's payback?

A) 2.03 years

B) 2.25 years

C) 2.50 years

D) 2.75 years

E) 3.03 years

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 108

Related Exams