A) $12,600

B) $11,880

C) $13,350

D) $11,265

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Methods that ignore present value in capital investment analysis include the average rate of return method.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Average rate of return equals estimated average annual income divided by average investment.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a proposed expenditure of $80,000 for a fixed asset with a 4-year life has an annual expected net cash flow and net income of $32,000 and $12,000,respectively,the cash payback period is 4 years.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All of the following are factors that may complicate capital investment analysis except

A) possible leasing alternatives

B) changes in price levels

C) sunk costs

D) federal income tax ramifications

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each definition that follows with the term (a-f) it defines. -A stream of equal cash flow amounts

A) Capital rationing

B) Annuity

C) Capital investment analysis

D) Internal rate of return method

E) Payback period

F) Accounting rate of return

H) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

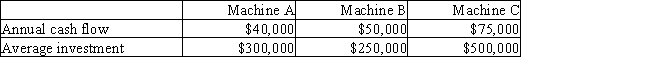

The production department is proposing the purchase of an automatic insertion machine.It has identified 3 machines and has asked the accountant to analyze them to determine the best cash payback.

A) Machine A

B) Machine C

C) Machine B

D) All are equal.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A company is considering the purchase of a new piece of equipment for $90,000.Predicted annual net cash inflows from the investment are $36,000 (Year 1),$30,000 (Year 2),$18,000 (Year 3),$12,000 (Year 4),and $6,000 (Year 5).The average income from operations over the 5-year life is $20,400.The payback period is 3.5 years.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Using the tables above,what would be the present value of $15,000 to be received at the end of each of the next 2 years,assuming an earnings rate of 6%?

A) $27,495

B) $26,040

C) $30,000

D) $25,350

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company is contemplating investing in a new piece of manufacturing machinery.The amount to be invested is $100,000.The present value of the future cash flows at the company's desired rate of return is $100,000.The IRR on the project is 12%.Which of the following statements is true?

A) The project should not be accepted because the net present value is negative.

B) The desired rate of return used to calculate the present value of the future cash flows is less than 12%.

C) The desired rate of return used to calculate the present value of the future cash flows is more than 12%.

D) The desired rate of return used to calculate the present value of the future cash flows is equal to 12%.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The present value index for this investment is

A) 1.00

B) 0.95

C) 1.25

D) 1.05

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company is contemplating investing in a new piece of manufacturing machinery.The amount to be invested is $210,000.The present value of the future cash flows is $225,000.The company's desired rate of return used in the present value calculations was 12%.Which of the following statements is true?

A) The project should not be accepted because the net present value is negative.

B) The internal rate of return on the project is less than 12%.

C) The internal rate of return on the project is more than 12%.

D) The internal rate of return on the project is equal to 12%.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If in evaluating a proposal by use of the net present value method there is a deficiency of the present value of future cash inflows over the amount to be invested,the proposal should be rejected.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A series of equal cash flows at fixed intervals is termed a(n)

A) present value index

B) price-level index

C) net cash flow

D) annuity

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

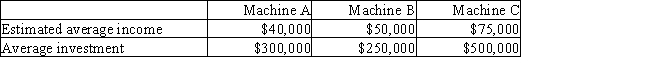

The production department is proposing the purchase of an automatic insertion machine.It has identified 3 machines and has asked the accountant to analyze them to determine the best average rate of return.

A) Machine B

B) Machine C

C) Machine B or C

D) Machine A

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The primary advantages of the average rate of return method are its ease of computation and the fact that

A) it is especially useful to managers whose primary concern is liquidity

B) there is less possibility of loss from changes in economic conditions and obsolescence when the commitment is short-term

C) it emphasizes the amount of income earned over the life of the proposal

D) rankings of proposals are necessary

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

In net present value analysis for a proposed capital investment,the expected future net cash flows are averaged and then reduced to their present values.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Periods in time that experience increasing price levels are known as periods of

A) inflation

B) recession

C) depression

D) deflation

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Using the tables above,if an investment is made now for $23,500 that will generate a cash inflow of $8,000 a year for the next 4 years,what would be the net present value of the investment,assuming an earnings rate of 10%?

A) $23,500

B) $16,050

C) $25,360

D) $1,860

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The anticipated purchase of a fixed asset for $400,000,with a useful life of 5 years and no residual value,is expected to yield total net income of $300,000 for the 5 years.The expected average rate of return is 37.5%.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 161 - 180 of 186

Related Exams