A) interest value

B) maturity value

C) face value

D) issuance value

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Essay

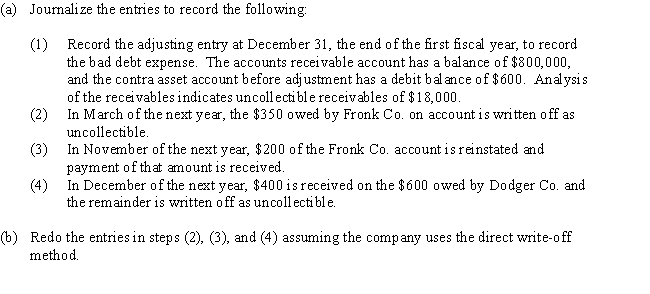

For a business that uses the allowance method of accounting for uncollectible receivables:

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Notes or accounts receivable that result from sales transactions are often called

A) nontrade receivables

B) trade receivables

C) merchandise receivables

D) sales receivables

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

When using the percent of sales method of estimating uncollectibles,the entry to record bad debt expense includes a credit to Accounts Receivable.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Selling receivables

A) shifts some of the risk to the buyer

B) delays the receipt of cash

C) occurs when an account becomes uncollectible

D) results in bad debt expense

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

At the end of a period (before adjustment),Allowance for Doubtful Accounts has a debit balance of $500.Credit sales for the period total $800,000.If bad debt expense is estimated at 1% of credit sales,the amount of bad debt expense to be recorded in the adjusting entry is $8,500.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The balance of Allowance for Doubtful Accounts is added to Accounts Receivable on the balance sheet.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under the direct write-off method of accounting for uncollectible accounts,Bad Debt Expense is recorded

A) at the end of each accounting period

B) when a credit sale is past due

C) whenever a predetermined amount of credit sales has been made

D) when an account is determined to be worthless

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company uses the allowance method to account for uncollectible accounts receivable.When the firm writes off a specific customer's account receivable,

A) total current assets are reduced

B) total expenses for the period are increased

C) the net realizable value of accounts receivable increases

D) there is no effect on total current assets or total expenses

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each description to the appropriate term (a-d) . Each term may be used more than once. -With this method,there is no allowance account.

A) Direct write-off method

B) Aging of receivables method

C) Percent of sales method

D) Allowance method

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under the allowance method of accounting for uncollectible receivables,writing off an uncollectible account

A) affects only income statement accounts

B) is not an acceptable practice

C) affects only balance sheet accounts

D) affects both balance sheet and income statement accounts

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The due date of a 60-day note dated July 10 is September 10.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 181 - 192 of 192

Related Exams