A) debit to Allowance for Doubtful Accounts

B) credit to Cash

C) debit to Accounts Receivable-James

D) credit to Bad Debt Expense

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Allowance for Doubtful Accounts has a credit balance of $500 at the end of the year (before adjustment) ,and bad debt expense is estimated at 3% of credit sales.If credit sales are $300,000,the amount of the adjusting entry to record the estimated uncollectible accounts receivable

A) is $8,500

B) is $9,500

C) is $9,000

D) cannot be determined

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

GAAP requires companies with a large amount of receivables to use the allowance method.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Using the allowance method of accounting for uncollectible receivables,the entry to reinstate a specific receivable previously written off would include a

A) credit to Bad Debt Expense

B) credit to Accounts Receivable

C) debit to Allowance for Doubtful Accounts

D) debit to Accounts Receivable

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Given the following information,compute accounts receivable turnover.

A) 6.75

B) 7.50

C) 6.13

D) 6.82

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

When accounting for uncollectible receivables and using the percentage of sales method,the matching principle is violated.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

At the end of a period (before adjustment),Allowance for Doubtful Accounts has a debit balance of $2,000.The Accounts Receivable balance is analyzed by aging the accounts,and the amount estimated to be uncollectible is $15,000.The amount to be recorded in the adjusting entry for the bad debt expense is $15,000.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each description to the appropriate term (a-h) . -The party promising to pay a note

A) Face amount

B) Term

C) Interest

D) Maturity value

E) Dishonored note

F) Maker

G) Notes receivable

H) Interest rate

J) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each description to the appropriate term (a-h) . -A note that is not paid when it is due

A) Face amount

B) Term

C) Interest

D) Maturity value

E) Dishonored note

F) Maker

G) Notes receivable

H) Interest rate

J) C) and G)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jefferson uses the percent of sales method of estimating uncollectible expenses.Based on past history,2% of credit sales are expected to be uncollectible.Sales for the current year are $5,550,000.Which of the following is correct regarding the entry to record estimated uncollectible receivables?

A) Cash will be debited.

B) Bad Debt Expense will be credited.

C) Allowance for Doubtful Accounts will be credited.

D) Accounts Receivable will be debited.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each description to the appropriate term (a-d) . Each term may be used more than once. -This method focuses on the income statement.

A) Direct write-off method

B) Aging of receivables method

C) Percent of sales method

D) Allowance method

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following receivables would not be classified as an "other receivable"?

A) advance to an employee

B) interest receivable

C) refundable income tax

D) notes receivable

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a company receives an interest-bearing note receivable,it will

A) debit Notes Receivable for the maturity value of the note

B) debit Notes Receivable for the face value of the note

C) credit Notes Receivable for the maturity value of the note

D) credit Notes Receivable for the face value of the note

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When referring to a note receivable or promissory note,

A) the maker is the party to whom the money is due

B) the note is not considered a formal credit instrument

C) the note cannot be factored to another party

D) the note may be used to settle an accounts receivable

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Allowance for Doubtful Accounts has a debit balance of $2,300 at the end of the year (before adjustment) .The company prepares an analysis of customers' accounts and estimates the amount of uncollectible accounts to be $31,900.Which of the following adjusting entries is needed to record the bad debt expense for the year?

A) debit Bad Debt Expense, $34,200; credit Allowance for Doubtful Accounts, $34,200

B) debit Allowance for Doubtful Accounts, $34,200; credit Bad Debt Expense, $34,200

C) debit Allowance for Doubtful Accounts, $29,600; credit Bad Debt Expense, $29,600

D) debit Bad Debt Expense, $29,600; credit Allowance for Doubtful Accounts, $29,600

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If the maker of a note fails to pay the debt on the due date,the note is said to be dishonored.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each description to the appropriate term (a-h) . -The dollar amount stated on a promissory note

A) Face amount

B) Term

C) Interest

D) Maturity value

E) Dishonored note

F) Maker

G) Notes receivable

H) Interest rate

J) B) and C)

Correct Answer

verified

Correct Answer

verified

Essay

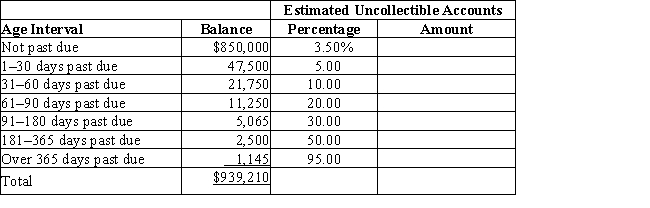

(a)The aging of Torme Designs' accounts receivable is shown below.Calculate the amount of each periodicity range that is deemed to be uncollectible.  (b) If Allowance for Doubtful Accounts has a credit balance of $1,135.00,record the adjusting entry forthe bad debt expense for the year.

(b) If Allowance for Doubtful Accounts has a credit balance of $1,135.00,record the adjusting entry forthe bad debt expense for the year.

Correct Answer

verified

Correct Answer

verified

True/False

Other receivables include nontrade receivables such as loans to company officers.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One of the weaknesses of the direct write-off method is that it

A) understates accounts receivable on the balance sheet

B) violates the matching principle

C) is too difficult to use for many companies

D) is based on estimates

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 192

Related Exams