B) False

Correct Answer

verified

Correct Answer

verified

Essay

Sabas Company has 20,000 shares of $100 par,2% cumulative preferred stock and 100,000 shares of $50 par common stock.The following amounts were distributed as dividends:  Determine the dividends per share for preferred and common stock for each year.

Determine the dividends per share for preferred and common stock for each year.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Dayton Corporation began the current year with a retained earnings balance of $32,000.During the year,the company corrected an error made in the prior year,which was a failure to record a depreciation expense of $3,000 on equipment.Also,during the current year,the company earned net income of $12,000 and declared cash dividends of $7,000.Compute the year-end retained earnings balance.

A) $34,000

B) $37,000

C) $41,000

D) $44,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each of the following stockholders' equity concepts to the most appropriate term (a-h) . -The number of shares sold to stockholders

A) Authorized shares

B) Issued shares

C) Outstanding shares

D) Par value

E) Common stock

F) Preferred stock

G) Paid-In Capital in Excess of Par

H) Transfer agent

J) A) and F)

Correct Answer

verified

Correct Answer

verified

Essay

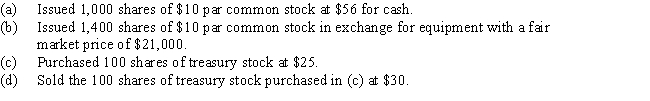

Prepare entries to record the following:

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Treasury stock that had been purchased for $5,600 last month was reissued this month for $8,500.The journal entry to record the reissuance would include a credit to

A) Treasury Stock for $8,500

B) Paid-In Capital from Sale of Treasury Stock for $8,500

C) Paid-In Capital in Excess of Par-Common Stock for $2,900

D) Paid-In Capital from Sale of Treasury Stock for $2,900

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A corporation purchased 1,000 shares of its own $5 par common stock at $10 and subsequently sold 500 of the shares at $20.What amount of revenue is realized from the sale?

A) $0

B) $5,000

C) $2,500

D) $10,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The number of shares of outstanding stock is equal to the number of shares authorized minus the number of shares issued.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The charter of a corporation provides for the issuance of 100,000 shares of common stock.Assume that 40,000 shares were originally issued and 10,000 were subsequently reacquired.What is the number of shares outstanding?

A) 10,000

B) 40,000

C) 30,000

D) 50,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each of the following stockholders' equity concepts to the appropriate term (a-h) . -Cash distribution of a company's earnings to stockholders

A) Cash dividend

B) Date of record

C) Stock Dividends Distributable

D) Date of declaration

E) Treasury stock

F) Preferred stock

G) Date of payment

H) Paid-In Capital in Excess of Par

J) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If a corporation is liquidated,preferred stockholders are paid before the creditors and before the common stockholders.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If 50,000 shares are authorized,41,000 shares are issued,and 2,000 shares are reacquired,the number of outstanding shares is 43,000.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each of the following stockholders' equity concepts to the appropriate term (a-h) . -A company whose shares can be bought and sold in public markets

A) Articles of incorporation

B) Limited liability

C) Bylaws

D) Corporation

E) Public corporation

F) Board of directors

G) Private corporation

H) Dividends

J) A) and F)

Correct Answer

verified

Correct Answer

verified

True/False

When common stock is issued in exchange for land,the land should be recorded in the accounts at the par value of the stock issued.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kansas Company acquired a building valued at $210,000 for property tax purposes in exchange for 12,000 shares of its $5 par common stock.The stock is widely traded and selling for $15 per share.At what amount should the building be recorded by Kansas Company?

A) $60,000

B) $180,000

C) $210,000

D) $120,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Essay

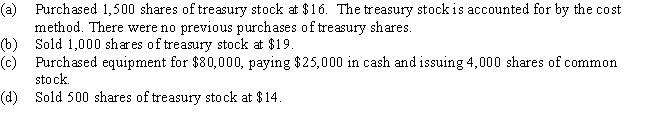

A company has 10,000 shares of $10 par common stock outstanding.Prepare entries to record the following:

Correct Answer

verified

Correct Answer

verified

Essay

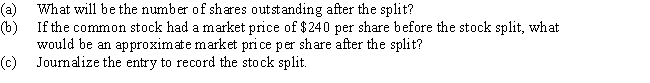

A corporation,which had 18,000 shares of common stock outstanding,declared a 3-for-1 stock split.

Correct Answer

verified

Correct Answer

verified

Essay

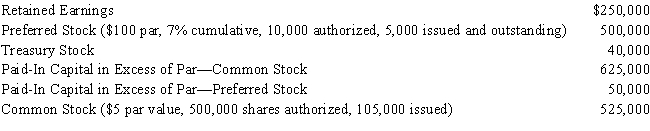

At December 31,Idaho Company had the following ending account balances:  Prepare the Stockholders' equity section of the balance sheet in good form with all of the required disclosures.

Prepare the Stockholders' equity section of the balance sheet in good form with all of the required disclosures.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A disadvantage of the corporate form of business entity is

A) mutual agency for stockholders

B) unlimited liability for stockholders

C) corporations are subject to more governmental regulations

D) the ease of transfer of ownership

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

When no-par common stock with a stated value is issued for cash,the common stock account is credited for an amount equal to the cash proceeds.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 141 - 160 of 215

Related Exams