Filters

Question type

Correct Answer

verified

Correct Answer

verified

Question 102

Multiple Choice

The relationship of $325,000 to $125,000, expressed as a ratio, is

A) 2.0 to 1

B) 2.6 to 1

C) 2.5 to 1

D) 0.45 to 1

E) None of the above

F) A) and D)

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Question 103

Multiple Choice

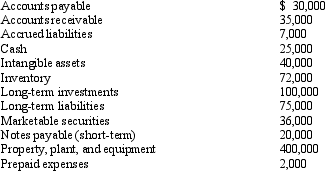

Based on the above data, what is the amount of quick assets?

Based on the above data, what is the amount of quick assets?

A) $168,000

B) $96,000

C) $60,000

D) $61,000

E) C) and D)

F) All of the above

F) All of the above

Correct Answer

verified

Correct Answer

verified

Question 104

Multiple Choice

Which of the following ratios provides a solvency measure that shows the margin of safety of bondholders and also gives an indication of the potential ability of the business to borrow additional funds on a long-term basis?

A) ratio of fixed assets to long-term liabilities

B) ratio of net sales to assets

C) number of days' sales in receivables

D) rate earned on stockholders' equity

E) B) and C)

F) All of the above

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 181 - 184 of 184

Related Exams