Correct Answer

verified

Correct Answer

verified

Essay

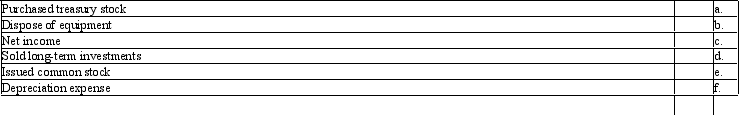

For each of the following, identify whether it would be disclosed as an operating (O), financing (F), or investing (I) activity on the statement of cash flows under the indirect method.

Correct Answer

verified

Correct Answer

verified

Essay

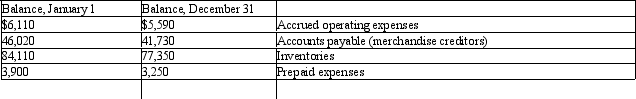

Selected data taken from the accounting records of Laser Inc. for the current year ended December 31, are as follows:

During the current year, the cost of merchandise sold was $448,500, and the operating expenses other than depreciation were $78,000. The direct method is used for presenting the cash flows from operating activities on the statement of cash flows.

Required:

Determine the amount reported on the statement of cash flows for:

(1) Cash payments for merchandise; and

(2) Cash payments for operating expenses.

During the current year, the cost of merchandise sold was $448,500, and the operating expenses other than depreciation were $78,000. The direct method is used for presenting the cash flows from operating activities on the statement of cash flows.

Required:

Determine the amount reported on the statement of cash flows for:

(1) Cash payments for merchandise; and

(2) Cash payments for operating expenses.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On the statement of cash flows, the cash flows from financing activities section would include all of the following except

A) receipts from the sale of bonds payable

B) payments for dividends

C) payments for purchase of treasury stock

D) payments of interest on bonds payable

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Depreciation on factory equipment would be reported in the statement of cash flows prepared by the indirect method in

A) the cash flows from financing activities section

B) the cash flows from investing activities section

C) a separate schedule

D) the cash flows from operating activities section

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Free cash flow is cash from operations, less cash for

A) dividends and cash for fixed assets needed to maintain productivity

B) dividends and cash to redeem bonds payable

C) fixed assets needed to maintain productivity

D) dividends, cash for fixed assets needed to maintain productivity, and cash to redeem bonds payable

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The statement of cash flows reports a firm's major sources of cash receipts and major uses of cash payments for a period.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

When using the work sheet method to analyzing noncash accounts , no order of analysis is required, but it is more efficient to start with Retained Earnings and proceed upward in the account listing.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The manner of reporting cash flows from investing and financing activities will be different under the direct method as compared to the indirect method.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Discount Sales sells some used store fixtures. The acquisition cost of the fixtures is $12,500, the accumulated depreciation on these fixtures is $9,750 at the time of sale. The fixtures are sold for $4,500. The value of this transaction in the Investing section of the statement of cash flows is:

A) $12,500

B) $4,500

C) $2,750

D) $1,750

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

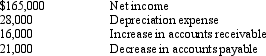

The following information is available from the current period financial statements:  The net cash flow from operating activities using the indirect method is

The net cash flow from operating activities using the indirect method is

A) $230,000

B) $188,000

C) $198,000

D) $156,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following should be deducted from net income in calculating net cash flow from operating activities using the indirect method?

A) a decrease in inventory

B) a decrease in accounts payable

C) preferred dividends declared and paid

D) a decrease in accounts receivable

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cash dividends of $85,000 were declared during the year. Cash dividends payable were $10,000 at the beginning of the year and $15,000 at the end of the year. The amount of cash for the payment of dividends during the year is

A) $90,000

B) $80,000

C) $95,000

D) $75,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not one of the four basic financial statements?

A) balance sheet

B) statement of cash flows

C) statement of changes in financial position

D) income statement

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Accounts receivable resulting from sales to customers amounted to $40,000 and $31,000 at the beginning and end of the year, respectively. Income reported on the income statement for the year was $120,000. Exclusive of the effect of other adjustments, the cash flows from operating activities to be reported on the statement of cash flows is

A) $120,000.

B) $129,000.

C) $151,000.

D) $111,000.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The last item on the statement of cash flows prior to the schedule of noncash investing and financing activities reports

A) the increase or decrease in cash

B) cash at the end of the year

C) net cash flow from investing activities

D) net cash flow from financing activities

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would not be found in a Schedule of Noncash Investing and Financing Activities, reported at the end of a Statement of Cash Flows?

A) equipment acquired in exchange for a note payable

B) bonds payable exchanged for capital stock

C) purchase of treasury stock

D) capital stock issued to acquire fixed assets

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Net income was $51,000 for the year. The accumulated depreciation balance increased by $14,000 over the year. There were no sales of fixed assets or changes in noncash current assets or liabilities. Under the indirect method, the cash flow from operations is $37,000.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Cash flows from investing activities, as part of the statement of cash flows, include payments for the acquisition of fixed assets.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In preparing the cash flows from operating activities section of the statement of cash flows by the indirect method, the net decrease in inventories from the beginning to the end of the period is added to net income for the period.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 162

Related Exams