B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The charter of a corporation provides for the issuance of 100,000 shares of common stock. Assume that 60,000 shares were originally issued and 5,000 were subsequently reacquired. What is the amount of cash dividends to be paid if a $1 per share dividend is declared?

A) $60,000

B) $5,000

C) $100,000

D) $55,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a corporation completes a 3-for-1 stock split

A) the ownership interest of current stockholders is decreased

B) the market price per share of the stock is decreased

C) the par value per share is decreased

D) b and c

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A corporation has 60,000 shares of $25 par value stock outstanding that has a current market value of $120. If the corporation issues a 5-for-1 stock split, the number of shares outstanding will be:

A) 60,000

B) 10,000

C) 300,000

D) 30,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The main source of paid-in-capital is from issuing stock.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A corporation issues 1,500 shares of common stock for $ 32,000. The stock has a stated value of $10 per share. The journal entry to record the stock issuance would include a credit to Common Stock for

A) $15,000

B) $32,000

C) $17,000

D) $2,000

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The primary purpose of a stock split is to

A) increase paid-in capital

B) reduce the market price of the stock per share

C) increase the market price of the stock per share

D) increase retained earnings

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Double taxation is a disadvantage of a corporation because the same party has to pay taxes twice on the income.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The amount of capital paid in by the stockholders of the corporation is called legal capital.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The par value of stock is an arbitrary per share amount defined in many states as legal capital.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The primary purpose of a stock split is to reduce the number of shares outstanding in order to encourage more investors to enter the market for the company's shares.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The declaration of a cash dividend decreases a corporation's stockholders equity and decreases its assets.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

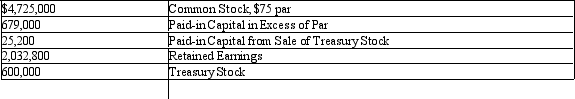

Using the following information, prepare the Stockholders' Equity section of the balance sheet. Seventy thousand shares of common stock are authorized and 7,000 shares have been reacquired.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a right possessed by common stockholders of a corporation?

A) the right to vote in the election of the board of directors

B) the right to receive a minimum amount of dividends

C) the right to sell their stock to anyone they choose

D) the right to share in assets upon liquidation

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The par value of common stock must always be equal to its market value on the date the stock is issued.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Dayton Corporation began the current year with a retained earnings balance of $25,000. During the year, the company corrected an error made in the prior year, which was a failure to record depreciation expense of $3,000 on equipment. Also, during the current year, the company earned net income of $12,000 and declared cash dividends of $5,000. Compute the year end retained earnings balance.

A) $29,000

B) $35,000

C) $39,000

D) $45,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Essay

On May 1, 10,000 shares of $10 par common stock were issued at $30, and on May 7, 5,000 shares of $50 par preferred stock were issued at $111. Journalize the entries for May 1 and May 7.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1, 20xx, Swenson Corporation had 40,000 shares of $10 par value common stock issued and outstanding. All 40,000 shares had been issued in a prior period at $20.00 per share. On February 1, 20xx, Swenson purchased 2,000 shares of treasury stock for $24 per share and later sold the treasury shares for $21 per share on March 1, 20xx. The journal entry to record the purchase of the treasury shares on February 1, 20xx, would include a

A) credit to Treasury Stock for $48,000.

B) debit to Treasury Stock for $48,000.

C) debit to a loss account for $6,000

D) credit to a gain account for $6,000.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The entry to record the issuance of 150 shares of $5 par common stock at par to an attorney in payment of legal fees for organizing the corporation includes a credit to

A) Organizational Expenses

B) Goodwill

C) Common Stock

D) Cash

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The par value per share of common stock represents

A) the minimum selling price of the stock established by the articles of incorporation.

B) the minimum amount the stockholder will receive when the corporation is liquidated

C) an arbitrary amount established in the articles of incorporation

D) the amount of dividends per share to be received each year

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 141 - 160 of 168

Related Exams