B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Under current laws and regulations, corporations must use straight-line depreciation for all assets whose lives are 5 years or longer.

B) Corporations must use the same depreciation method for both stockholder reporting and tax purposes.

C) Using accelerated depreciation rather than straight line normally has the effect of speeding up cash flows and thus increasing a project's forecasted NPV.

D) Using accelerated depreciation rather than straight line normally has no effect on a project's total projected cash flows nor would it affect the timing of those cash flows or the resulting NPV of the project.

E) Since depreciation is a cash expense, the faster an asset is depreciated, the lower the projected NPV from investing in the asset.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

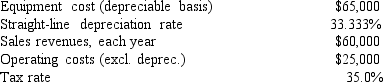

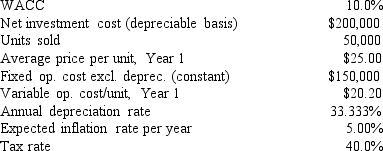

Fitzgerald Computers is considering a new project whose data are shown below.The required equipment has a 3-year tax life, after which it will be worthless, and it will be depreciated by the straight-line method over 3 years.Revenues and other operating costs are expected to be constant over the project's 3-year life.What is the project's Year 1 cash flow?

A) $28, 115

B) $28, 836

C) $29, 575

D) $30, 333

E) $31, 092

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Wansley Enterprises is considering a new project.The company has a beta of 1.0, and its sales and profits are positively correlated with the overall economy.The company estimates that the proposed new project would have a higher standard deviation and coefficient of variation than an average company project.Also, the new project's sales would be countercyclical in the sense that they would be high when the overall economy is down and low when the overall economy is strong.On the basis of this information, which of the following statements is CORRECT?

A) The proposed new project would increase the firm's corporate risk.

B) The proposed new project would increase the firm's market risk.

C) The proposed new project would not affect the firm's risk at all.

D) The proposed new project would have less stand-alone risk than the firm's typical project.

E) The proposed new project would have more stand-alone risk than the firm's typical project.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Changes in net working capital should not be reflected in a capital budgeting cash flow analysis because capital budgeting relates to fixed assets, not working capital.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Sunk costs must be considered if the IRR method is used but not if the firm relies on the NPV method.

B) A good example of a sunk cost is a situation where a bank opens a new office, and that new office leads to a decline in deposits of the bank's other offices.

C) A good example of a sunk cost is money that a banking corporation spent last year to investigate the site for a new office, then expensed that cost for tax purposes, and now is deciding whether to go forward with the project.

D) If sunk costs are considered and reflected in a project's cash flows, then the project's calculated NPV will be higher than it otherwise would be.

E) An example of a sunk cost is the cost associated with restoring the site of a strip mine once the ore has been depleted.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

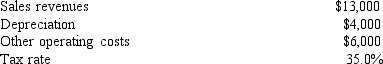

You have just landed an internship in the CFO's office of Hawkesworth Inc.Your first task is to estimate the Year 1 cash flow for a project with the following data.What is the Year 1 cash flow?

A) $5, 950

B) $6, 099

C) $6, 251

D) $6, 407

E) $6, 568

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) In a capital budgeting analysis where part of the funds used to finance the project would be raised as debt, failure to include interest expense as a cost when determining the project's cash flows will lead to a downward bias in the NPV.

B) The existence of any type of "externality" will reduce the calculated NPV versus the NPV that would exist without the externality.

C) If one of the assets to be used by a potential project is already owned by the firm, and if that asset could be sold or leased to another firm if the new project were not undertaken, then the net after-tax proceeds that could be obtained should be charged as a cost to the project under consideration.

D) If one of the assets to be used by a potential project is already owned by the firm but is not being used, then any costs associated with that asset is a sunk cost and should be ignored.

E) In a capital budgeting analysis where part of the funds used to finance the project would be raised as debt, failure to include interest expense as a cost when determining the project's cash flows will lead to an upward bias in the NPV.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A firm that bases its capital budgeting decisions on either NPV or IRR will be more likely to accept a given project if it uses accelerated depreciation than if it uses straight-line depreciation, other things being equal.

B) False

Correct Answer

verified

Correct Answer

verified

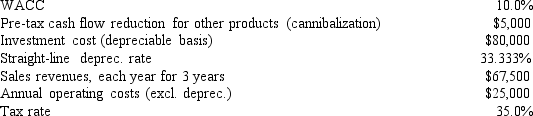

Multiple Choice

Weston Clothing Company is considering manufacturing a new style of shirt, whose data are shown below.The equipment to be used would be depreciated by the straight-line method over its 3-year life and would have a zero salvage value, and no new working capital would be required.Revenues and other operating costs are expected to be constant over the project's 3-year life.However, this project would compete with other Weston's products and would reduce their pre-tax annual cash flows.What is the project's NPV? (Hint: Cash flows are constant in Years 1-3.)

A) $3, 636

B) $3, 828

C) $4, 019

D) $4, 220

E) $4, 431

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Any cash flows that can be classified as incremental to a particular project¾i.e., results directly from the decision to undertake the project¾should be reflected in the capital budgeting analysis.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When evaluating a new project, firms should include in the projected cash flows all of the following EXCEPT:

A) Previous expenditures associated with a market test to determine the feasibility of the project, provided those costs have been expensed for tax purposes.

B) The value of a building owned by the firm that will be used for this project.

C) A decline in the sales of an existing product, provided that decline is directly attributable to this project.

D) The salvage value of assets used for the project that will be recovered at the end of the project's life.

E) Changes in net working capital attributable to the project.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

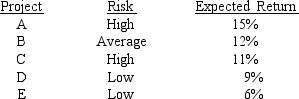

Multiple Choice

Laramie Labs uses a risk-adjustment when evaluating projects of different risk.Its overall (composite) WACC is 10%, which reflects the cost of capital for its average asset.Its assets vary widely in risk, and Laramie evaluates low-risk projects with a WACC of 8%, average-risk projects at 10%, and high-risk projects at 12%.The company is considering the following projects:

Which set of projects would maximize shareholder wealth?

Which set of projects would maximize shareholder wealth?

A) A and B.

B) A, B, and C.

C) A, B, and D.

D) A, B, C, and D.

E) A, B, C, D, and E.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following factors should be included in the cash flows used to estimate a project's NPV?

A) Interest on funds borrowed to help finance the project.

B) The end-of-project recovery of any working capital required to operate the project.

C) Cannibalization effects, but only if those effects increase the project's projected cash flows.

D) Expenditures to date on research and development related to the project, provided those costs have already been expensed for tax purposes.

E) All costs associated with the project that have been incurred prior to the time the analysis is being conducted.

G) B) and D)

Correct Answer

verified

B

Correct Answer

verified

True/False

The primary advantage to using accelerated rather than straight-line depreciation is that with accelerated depreciation the total amount of depreciation that can be taken, assuming the asset is used for its full tax life, is greater.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Collins Inc.is investigating whether to develop a new product.In evaluating whether to go ahead with the project, which of the following items should NOT be explicitly considered when cash flows are estimated?

A) The project will utilize some equipment the company currently owns but is not now using.A used equipment dealer has offered to buy the equipment.

B) The company has spent and expensed for tax purposes $3 million on research related to the new detergent.These funds cannot be recovered, but the research may benefit other projects that might be proposed in the future.

C) The new product will cut into sales of some of the firm's other products.

D) If the project is accepted, the company must invest $2 million in working capital.However, all of these funds will be recovered at the end of the project's life.

E) The company will produce the new product in a vacant building that was used to produce another product until last year.The building could be sold, leased to another company, or used in the future to produce another of the firm's products.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Shultz Business Systems is analyzing an average-risk project, and the following data have been developed.Unit sales will be constant, but the sales price should increase with inflation.Fixed costs will also be constant, but variable costs should rise with inflation.The project should last for 3 years, it will be depreciated on a straight-line basis, and there will be no salvage value.This is just one of many projects for the firm, so any losses can be used to offset gains on other firm projects.What is the project's expected NPV?

A) $15, 925

B) $16, 764

C) $17, 646

D) $18, 528

E) $19, 455

G) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

The change in net working capital associated with new projects is always positive, because new projects mean that more working capital will be required.This situation is especially true for replacement projects.

B) False

Correct Answer

verified

False

Correct Answer

verified

True/False

Because of differences in the expected returns on different investments, the standard deviation is not always an adequate measure of risk.However, the coefficient of variation adjusts for differences in expected returns and thus allows investors to make better comparisons of investments' stand-alone risk.

B) False

Correct Answer

verified

True

Correct Answer

verified

Multiple Choice

Which of the following should be considered when a company estimates the cash flows used to analyze a proposed project?

A) Since the firm's director of capital budgeting spent some of her time last year to evaluate the new project, a portion of her salary for that year should be charged to the project's initial cost.

B) The company has spent and expensed $1 million on R&D associated with the new project.

C) The company spent and expensed $10 million on a marketing study before its current analysis regarding whether to accept or reject the project.

D) The firm would borrow all the money used to finance the new project, and the interest on this debt would be $1.5 million per year.

E) The new project is expected to reduce sales of one of the company's existing products by 5%.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 78

Related Exams