A) One nice feature of dividend reinvestment plans (DRIPs) is that they reduce the taxes investors would have to pay if they received cash dividends.

B) Empirical research indicates that, in general, companies send a negative signal to the marketplace when they announce an increase in the dividend, and as a result share prices fall when dividend increases are announced.The reason is that investors interpret the increase as a signal that the firm has relatively few good investment opportunities.

C) If a company wants to raise new equity capital rather steadily over time, a new stock dividend reinvestment plan would make sense.However, if the firm does not want or need new equity, then an open market purchase dividend reinvestment plan would probably make more sense.

D) Dividend reinvestment plans have not caught on in most industries, and today about 99% of all companies with DRIPs are utilities.

E) Under the tax laws as they existed in 2008, a dollar received for repurchased stock must be taxed at the same rate as a dollar received as dividends.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be most likely to lead to a decrease in a firm's dividend payout ratio?

A) Its access to the capital markets increases.

B) Its R&D efforts pay off, and it now has more high-return investment opportunities.

C) Its accounts receivable decrease due to a change in its credit policy.

D) Its stock price has increased over the last year by a greater percentage than the increase in the broad stock market averages.

E) Its earnings become more stable.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following should not influence a firm's dividend policy decision?

A) A strong preference by most shareholders for current cash income versus capital gains.

B) Constraints imposed by the firm's bond indenture.

C) The fact that much of the firm's equipment has been leased rather than bought and owned.

D) The fact that Congress is considering changes in the tax law regarding the taxation of dividends versus capital gains.

E) The firm's ability to accelerate or delay investment projects.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sanchez Company has planned capital expenditures that total $2, 000, 000.The company wants to maintain a target capital structure that is 35% debt and 65% equity.The company forecasts that its net income this year will be $1, 800, 000.If the company follows a residual dividend policy, what will be its total dividend payment?

A) $100, 000

B) $200, 000

C) $300, 000

D) $400, 000

E) $500, 000

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

United Builders wants to maintain a target capital structure with 30% debt and 70% equity.Its forecasted net income is $550, 000, and because of market conditions, the company will not issue any new stock during the coming year.If the firm follows the residual dividend policy, what is the maximum capital budget that is consistent with maintaining the target capital structure?

A) $673, 652

B) $709, 107

C) $746, 429

D) $785, 714

E) $825, 000

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Even if a stock split has no information content, and even if the dividend per share adjusted for the split is not increased, there can still be a real benefit (i.e., a higher value for shareholders)from such a split, but any such benefit is probably small.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Victor Rumsfeld Inc.'s dividend policy is under review by its board.Its projected capital budget is $2, 000, 000, its target capital structure is 60% debt and 40% equity, and its forecasted net income is $600, 000.If the company follows a residual dividend policy, what total dividends, if any, will it pay out?

A) $240, 000

B) $228, 000

C) $216, 600

D) $205, 770

E) $0

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Consider two very different firms, M and N.Firm M is a mature firm in a mature industry.Its annual net income and net cash flows are both consistently high and stable.However, M's growth prospects are quite limited, so its capital budget is small relative to its net income.Firm N is a relatively new firm in a new and growing industry.Its markets and products have not stabilized, so its annual operating income fluctuates considerably.However, N has substantial growth opportunities, and its capital budget is expected to be large relative to its net income for the foreseeable future.Which of the following statements is correct?

A) Firm M probably has a higher dividend payout ratio than Firm N.

B) If the corporate tax rate increases, the debt ratio of both firms is likely to decline.

C) The two firms are equally likely to pay high dividends.

D) Firm N is likely to have a clientele of shareholders who want to receive consistent, stable dividend income.

E) Firm M probably has a lower debt ratio than Firm N.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Reynolds Paper Products Corporation follows a strict residual dividend policy.All else equal, which of the following factors would be most likely to lead to an increase in the firm's dividend per share?

A) The company increases the percentage of equity in its target capital structure.

B) The number of profitable potential projects increases.

C) Congress lowers the tax rate on capital gains.The remainder of the tax code is not changed.

D) Earnings are unchanged, but the firm issues new shares of common stock.

E) The firm's net income increases.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

If a firm adopts a residual distribution policy, distributions are determined as a residual after funding the capital budget.Therefore, the better the firm's investment opportunities, the lower its payout ratio should be.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The capital budget forecast for the Santano Company is $725, 000.The CFO wants to maintain a target capital structure of 45% debt and 55% equity, and it also wants to pay dividends of $500, 000.If the company follows the residual dividend policy, how much income must it earn, and what will its dividend payout ratio be? Net Income Payout

A) $ 898, 750..55.63%

B) $ 943, 688 58.41%

C) $ 990, 872 61.34%

D) $1, 040, 415 64.40%

E) $1, 092, 436 67.62%

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If the shape of the curve depicting a firm's WACC versus its debt ratio is more like a sharp "V", as opposed to a shallow "U", it will be easier for the firm to maintain a steady dividend in the face of varying investment opportunities or earnings from year to year.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

MM's dividend irrelevance theory says that while dividend policy does not affect a firm's value, it can affect the cost of capital.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

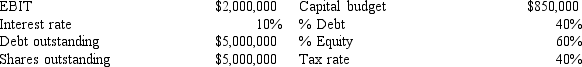

Silvana Inc.projects the following data for the coming year.If the firm follows the residual dividend policy and also maintains its target capital structure, what will its payout ratio be?

A) 37.2%

B) 39.1%

C) 41.2%

D) 43.3%

E) 45.5%

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Getler Inc.'s projected capital budget is $2, 000, 000, its target capital structure is 40% debt and 60% equity, and its forecasted net income is $1, 000, 000.If the company follows a residual dividend policy, how much dividends will it pay or, alternatively, how much new stock must it issue? Dividends Stock Issued

A) $514, 425 $162, 901

B) $541, 500 $171, 475

C) $570, 000 $180, 500

D) $600, 000 $190, 000

E) $0 $200, 000

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Poff Industries' stock currently sells for $120 a share.You own 100 shares of the stock.The company is contemplating a 2-for-1 stock split.Which of the following best describes what your position will be after such a split takes place?

A) You will have 200 shares of stock, and the stock will trade at or near $60 a share.

B) You will have 100 shares of stock, and the stock will trade at or near $60 a share.

C) You will have 50 shares of stock, and the stock will trade at or near $120 a share.

D) You will have 50 shares of stock, and the stock will trade at or near $60 a share.

E) You will have 200 shares of stock, and the stock will trade at or near $120 a share.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) The clientele effect can explain why so many firms change their dividend policies so often.

B) One advantage of adopting the residual dividend policy is that this policy makes it easier for corporations to develop a specific and well-identified dividend clientele.

C) New-stock dividend reinvestment plans are similar to stock dividends because they both increase the number of shares outstanding but don't change the firm's total amount of book equity.

D) Investors who receive stock dividends must pay taxes on the value of the new shares in the year the stock dividends are received.

E) If a firm follows the residual dividend policy, then a sudden increase in the number of profitable projects is likely to reduce the firm's dividend payout.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

One implication of the bird-in-the-hand theory of dividends is that a given reduction in dividend yield must be offset by a more than proportionate increase in growth in order to keep a firm's required return constant, other things held constant.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a firm adheres strictly to the residual dividend policy, the issuance of new common stock would suggest that

A) the dividend payout ratio is increasing.

B) no dividends were paid during the year.

C) the dividend payout ratio is decreasing.

D) the dollar amount of investments has decreased.

E) the dividend payout ratio has remained constant.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The capital budget of Creative Ventures Inc.is $1, 000, 000.The company wants to maintain a target capital structure that is 30% debt and 70% equity.The company forecasts that its net income this year will be $800, 000.If the company follows a residual dividend policy, what will be its total dividend payment?

A) $100, 000

B) $200, 000

C) $300, 000

D) $400, 000

E) $500, 000

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 58

Related Exams