B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On July 8, Alton Co. issued an $80,000, 6%, 120-day note payable to Seller Co. Assume that the fiscal year of Alton Co. ends July 31. Using the 360-day year in your calculations, what is the amount of interest expense recognized by Alton in the current fiscal year?

A) $1,200.00

B) $106.67

C) $306.67

D) $400.00

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is required to be withheld from employee's gross pay?

A) both federal and state unemployment compensation

B) only federal unemployment compensation tax

C) only federal income tax

D) only state unemployment compensation tax

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Quick assets include

A) cash; cash equivalents, receivables, prepaid expenses, and inventory

B) cash; cash equivalents, receivables, and prepaid expenses

C) cash; cash equivalents, receivables, and inventory

D) cash; cash equivalents, and receivables

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On June 8, Alton Co. issued an $90,000, 6%, 120-day note payable to Seller Co. Assuming a 360-day year for your calculations, what is the maturity value of the note?

A) $90,450

B) $90,000

C) $91,800

D) $95,400

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On June 8, Alton Co. issued an $80,000, 6%, 120-day note payable to Seller Co. Assume that the fiscal year of Seller Co. ends June 30. Using the 360-day year in your calculations, what is the amount of interest revenue recognized by Seller in the following year?

A) $1,200.00

B) $1,208.89

C) $1,306.67

D) $1,600.00

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The accounting for defined benefit plans is usually very easy and straight forward.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is the most desirable quick ratio?

A) 1.20

B) 1.00

C) 0.95

D) 0.50

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Current liabilities are:

A) due and receivable within one year.

B) due and to be paid out of current assets within one year.

C) due, but not payable for more than one year.

D) payable if a possible subsequent event occurs.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not an internal control procedure for payroll?

A) observe clocking in and out time for the employees

B) payroll depends on a fired employee's supervisor to notify them when an employee has been fired

C) payroll requires employees to show identification when picking up their paychecks

D) changes in pay rates on a computerized system must be tested by someone independent of payroll

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Form W-2 is called the Wage and Tax Statement.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

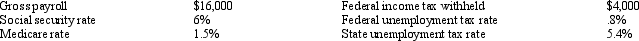

Assuming no employees are subject to ceilings for their earnings, Moore Company has the following information for the pay period of December 15 - 31, 20xx.  Salaries Payable would be recorded for

Salaries Payable would be recorded for

A) $16,000

B) $ 9,808

C) $10,800

D) $11,040

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Federal unemployment taxes are paid by the employer and the employee.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Federal unemployment compensation taxes that are collected by the federal government are paid directly to the unemployed but are allocated among the states for use in state programs.

B) False

Correct Answer

verified

Correct Answer

verified

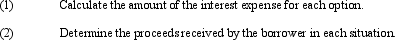

Essay

A borrower has two alternatives for a loan: (a) issue a $480,000, 60-day, 8% note or (2) issue a $480,000, 60-day note that the creditor discounts at 8%. (Assume a 360-day year is used for interest calculations.)

Required:

Correct Answer

verified

Correct Answer

verified

True/False

A loan in which the lender deducts interest from the amount borrowed before the money is advanced to the borrower is called an interest bearing note.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The discount on a note payable is charged to an account that has a normal credit balance.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The journal entry a company uses to record the estimated accrued product warranty liability is

A) debit Product Warranty Expense; credit Product Warranty Payable

B) debit Product Warranty Payable; credit Cash

C) debit Product Warranty Expense; credit Cash

D) debit Product Warranty Payable; credit Product Warranty Expense

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assuming a 360-day year, proceeds of $48,750 were received from discounting a $50,000, 90-day note at a bank. The discount rate used by the bank in computing the proceeds was

A) 6.25%

B) 10.00%

C) 10.26%

D) 9.75%

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The amount of money a borrower receives from the lender is called discount rate.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 169

Related Exams