B) False

Correct Answer

verified

Correct Answer

verified

True/False

If an investment project would make use of land which the firm currently owns,the project should be charged with the opportunity cost of the land.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

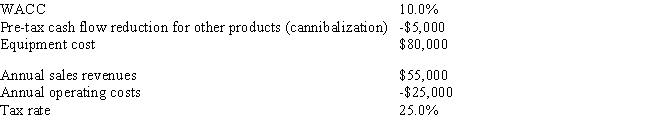

TexMex Food Company is considering a new salsa whose data are shown below.Under the new tax law,the equipment to be used in the project is eligible for 100% bonus depreciation,so it will be fully depreciated at t = 0.At the end of the project's life,the equipment would have zero salvage value,and no change in net operating working capital (NOWC) would be required for the project.Revenues and operating costs are expected to be constant over the project's 3-year life.However,this project would compete with other TexMex products and would reduce their pre-tax annual cash flows.What is the project's NPV? (Hint: Cash flows are constant in Years 1-3. ) Do not round the intermediate calculations and round the final answer to the nearest whole number.

A) -$4,152

B) -$3,848

C) -$13,372

D) -$4,253

E) -$14,432

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Other things held constant,which of the following would increase the NPV of a project being considered?

A) ![]()

B) Making the initial investment in the first year rather than spreading it over the first three years.

C) An increase in the discount rate associated with the project.

D) An increase in required net operating working capital (NOWC) .

E) The project would decrease sales of another product line.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Immediate expensing of depreciation has an advantage for profitable firms in that it moves cash flows forward,thus increasing their present value.On the other hand,in the year that depreciation is immediately expensed the reported current year's profits are lower because of the higher depreciation expenses.However,the reported profits problem can be solved by using different depreciation methods for tax and stockholder reporting purposes.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

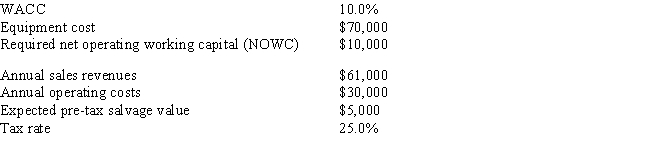

Thomson Media is considering some new equipment whose data are shown below.The equipment has a 3-year tax life.Under the new tax law,the equipment is eligible for 100% bonus depreciation,so it will be fully depreciated at t = 0.The equipment would have a positive pre-tax salvage value at the end of Year 3,when the project would be closed down.Also,additional net operating working capital (NOWC) would be required,but it would be recovered at the end of the project's life.Revenues and operating costs are expected to be constant over the project's 3-year life.What is the project's NPV? Do not round the intermediate calculations and round the final answer to the nearest whole number.

A) $5,650

B) $378

C) $344

D) $8,521

E) $2,543

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

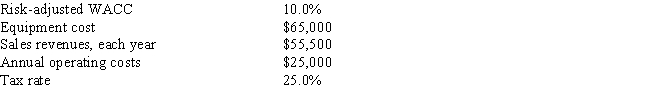

Temple Corp.is considering a new project whose data are shown below.The equipment that would be used has a 3-year tax life.Under the new tax law,the equipment used in the project is eligible for 100% bonus depreciation,so it will be fully depreciated at t = 0.The equipment would have a zero salvage value at the end of the project's life.No change in net operating working capital (NOWC) would be required.Revenues and operating costs are expected to be constant over the project's 3-year life.What is the project's NPV? Do not round the intermediate calculations and round the final answer to the nearest whole number.

A) $10,236

B) $3,350

C) $2,592

D) $8,137

E) $2,908

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following would NOT result in incremental cash flows and thus should NOT be included in the capital budgeting analysis for a new product?

A) A firm has a parcel of land that can be used for a new plant site or be sold,rented,or used for agricultural purposes.

B) A new product will generate new sales,but some of those new sales will be from customers who switch from one of the firm's current products.

C) A firm must obtain new equipment for the project,and $1 million is required for shipping and installing the new machinery.

D) A firm has spent $2 million on research and development associated with a new product.These costs have been expensed for tax purposes,and they cannot be recovered regardless of whether the new project is accepted or rejected.

E) A firm can produce a new product,and the existence of that product will stimulate sales of some of the firm's other products.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Sensitivity analysis is a good way to measure market risk because it explicitly takes into account diversification effects.

B) One advantage of sensitivity analysis relative to scenario analysis is that it explicitly takes into account the probability of specific effects occurring,whereas scenario analysis cannot account for probabilities.

C) Well-diversified stockholders do not need to consider market risk when determining required rates of return.

D) Market risk is important,but it does not have a direct effect on stock prices because it only affects beta.

E) Simulation analysis is a computerized version of scenario analysis where input variables are selected randomly on the basis of their probability distributions.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) An externality is a situation where a project would have an adverse effect on some other part of the firm's overall operations.If the project would have a favorable effect on other operations,then this is not an externality.

B) An example of an externality is a situation where a bank opens a new office,and that new office causes deposits in the bank's other offices to decline.

C) The NPV method automatically deals correctly with externalities,even if the externalities are not specifically identified,but the IRR method does not.This is another reason to favor the NPV.

D) Both the NPV and IRR methods deal correctly with externalities,even if the externalities are not specifically identified.However,the payback method does not.

E) Identifying an externality can never lead to an increase in the calculated NPV.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If a firm is found guilty of cannibalization in a court of law,then it is judged to have taken unfair advantage of its competitors.Thus,cannibalization is dealt with by society through the antitrust laws.

B) If a firm is found guilty of cannibalization in a court of law,then it is judged to have taken unfair advantage of its customers.Thus,cannibalization is dealt with by society through the antitrust laws.

C) If cannibalization exists,then the cash flows associated with the project must be increased to offset these effects.Otherwise,the calculated NPV will be biased downward.

D) If cannibalization is determined to exist,then this means that the calculated NPV if cannibalization is considered will be higher than the NPV if this effect is not recognized.

E) Cannibalization,as described in the text,is a type of externality that is not against the law,and any harm it causes is done to the firm itself.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As assistant to the CFO of Boulder Inc. ,you must estimate the Year 1 cash flow for a project with the following data.What is the Year 1 cash flow? Do not round the intermediate calculations and round the final answer to the nearest whole number.

A) $4,425

B) $4,554

C) $4,869

D) $4,240

E) $6,334

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company is considering a new project.The CFO plans to calculate the project's NPV by estimating the relevant cash flows for each year of the project's life (i.e. ,the initial investment cost,the annual operating cash flows,and the terminal cash flows) ,then discounting those cash flows at the company's overall WACC.Which one of the following factors should the CFO be sure to INCLUDE in the cash flows when estimating the relevant cash flows?

A) All sunk costs that have been incurred relating to the project.

B) All interest expenses on debt used to help finance the project.

C) The additional investment in net operating working capital (NOWC) required to operate the project,even if that investment will be recovered at the end of the project's life.

D) Sunk costs that have been incurred relating to the project,but only if those costs were incurred prior to the current year.

E) Effects of the project on other divisions of the firm,but only if those effects lower the project's own direct cash flows.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 73 of 73

Related Exams